Workers’ compensation laws by state determine how employees receive medical treatment and wage replacement after a work-related injury or illness. Every state has its own workers’ comp laws, so eligibility rules, claim deadlines, and employer coverage requirements differ across jurisdictions.

The laws protect employees injured on the job through a no-fault system that guarantees benefits while limiting employer liability. Some states require comp coverage when a business hires its first worker, while others wait until three, four, or more employees are on payroll. For example, California employers are subject to state workers’ comp laws immediately upon hiring.

A state-by-state comparison of workers’ compensation requirements shows how both federal laws and state laws interact, with distinct regulations across the Northeast, South, Midwest, and Western regions.

Key Takeaways

- Every state has its own workers’ compensation laws, defining who must carry coverage and how claims are filed.

- State-by-state comparison of workers’ compensation requirements shows major differences in coverage limits and reporting deadlines.

- Each state sets its own benefit amounts, including the minimum and maximum compensation payable for work-related injuries.

- Workers’ compensation laws protect employees injured on the job, ensuring medical care and wage replacement under state statutes.

- State requirements for workers’ compensation coverage vary states mandate all employers participate, while others have exemptions.

- The Law Office of Roy Yang helps workers understand state workers’ compensation laws and secure rightful benefits with skilled workers’ comp attorneys.

Workers’ Compensation Requirements in the Northeast States

Northeast state workers’ comp laws enforce broad workers’ comp coverage, but each legislature defines its own exemptions, thresholds, and regulatory body. Employers face penalties for failing to insure, and employees must follow state-specific claim procedures to secure benefits.

Northeast Region: State Workers’ Comp Laws (2026)

| State | Workers’ Comp Statute | Coverage Scope | Employer Mandate | Governing Agency |

|---|---|---|---|---|

| Connecticut | Conn. Gen. Stat. § 31-275 et seq. | Most employees; exclusions for sole proprietors and domestic workers unless they opt in | Required | Workers’ Compensation Commission |

| Maine | Me. Rev. Stat. tit. 39-A | All employees; some agricultural and casual labor excluded | Required | Workers’ Comp Board |

| Massachusetts | M.G.L. c. 152 | All employees, including part-time; proprietors and LLC members may opt in | Required | Department of Industrial Accidents (DIA) |

| New York | WCL § 1 et seq. | Nearly all employees; exemptions for clergy and volunteers | Required | Workers’ Compensation Board |

| New Hampshire | N.H. Rev. Stat. Ann. ch. 281-A | All employees; narrow farm and domestic worker exemptions | Required | Department of Labor |

| Rhode Island | R.I. Gen. Laws § 28-29 | Most employees; exemptions for very small employers | Required | Department of Labor & Training |

| Vermont | Vt. Stat. Ann. tit. 21, ch. 9 | Nearly all employees, including part-time | Required | Vermont Department of Labor |

| New Jersey | N.J. Stat. Ann. § 34:15 | Most employees; limited contractor exclusions | Required | Division of Workers’ Compensation |

| Pennsylvania | 77 Pa. Stat. § 1 | Nearly all employees; narrow contractor exemptions | Required | Department of Labor & Industry |

Regional trends: Wage replacement in the Northeast generally begins after a 3-7 day waiting period, depending on the state. Injury notice deadlines range from 30 days in New York to 120 days in Pennsylvania, with filing windows extending up to 2 years. Employees who report late often face delays in benefits, making early action essential.

State-Specific Workers’ Compensation Rules in the Southern Region

Southern states apply varied thresholds and exemptions in their workers’ compensation laws. Some require insurance with as few as two employees, while others mandate coverage only at five. Texas remains unique, as most private employers may opt out, though strict notice rules still apply.

Southern Region: Workers’ Compensation Laws by State (2026)

| State | Workers’ Comp Statute | Coverage Scope | Employer Mandate | Governing Agency |

|---|---|---|---|---|

| Delaware | Title 19, Ch. 23 | Most employees; limited exclusions | Required | Office of Workers’ Compensation |

| Florida | Ch. 440 | Most employees; industry-specific exceptions | Required, thresholds by industry | Division of Workers’ Compensation |

| Georgia | O.C.G.A. Title 34, Ch. 9 | Employees in businesses with ≥3 workers | Required | State Board of Workers’ Compensation |

| Maryland | Lab. & Empl. Title 9 | Nearly all employees | Required | Workers’ Compensation Commission |

| North Carolina | Ch. 97 | Most employees; narrow exemptions | Required, ≥3 employees | Industrial Commission |

| South Carolina | Title 42 | Most employees; exemptions for very small employers | Required, ≥4 employees | Workers’ Compensation Commission |

| Virginia | Title 65.2 | Nearly all employees | Required, ≥2 employees | Workers’ Compensation Commission |

| West Virginia | Ch. 23 | Most employees | Required | Offices of the Insurance Commissioner |

| Alabama | Title 25, Ch. 5 | Most employees | Required, ≥5 employees | Alabama Department of Labor |

| Kentucky | KRS Ch. 342 | Nearly all employees | Required | Department of Workers’ Claims |

| Mississippi | §71-3 | Most employees | Required, ≥5 employees | Workers’ Compensation Commission |

| Tennessee | Title 50, Ch. 6 | Most employees | Required, thresholds by industry | Bureau of Workers’ Compensation |

| Arkansas | Title 11, Ch. 9 | Nearly all employees | Required, ≥3 employees | Workers’ Compensation Commission |

| Louisiana | La. R.S. Title 23 | Most employees | Required | Office of Workers’ Compensation Administration |

| Oklahoma | Title 85A | Most employees | Required | Workers’ Compensation Commission |

| Texas | Lab. Code Title 5 | Most private employees | Optional for most private employers | Division of Workers’ Compensation (TDI-DWC) |

Regional trends: Most Southern states enforce a 3-7 day waiting period before wage replacement begins. Injury reporting deadlines usually fall between 30 and 90 days, with filing windows extending up to 2 years. Texas operates outside the traditional model, allowing private employers to remain nonsubscribers, but they must post clear notices and carry alternative coverage to avoid liability exposure.

Workers’ Compensation Regulations in the Midwest States

Midwestern states share broad coverage requirements but differ in how claims are administered. Most require all employers to carry insurance, though South Dakota allows limited exemptions. Ohio and North Dakota operate as monopolistic state funds, meaning private insurers cannot provide workers’ comp coverage there.

Midwest Region: State Workers’ Comp Laws (2026)

| State | Workers’ Comp Statute | Coverage Scope | Employer Mandate | Governing Agency |

|---|---|---|---|---|

| Illinois | 820 ILCS 305 | Nearly all employees | Required | Illinois Workers’ Compensation Commission |

| Indiana | Ind. Code Title 22, Art. 3 | Most employees; excludes some farm and domestic workers | Required | Workers’ Compensation Board of Indiana |

| Michigan | Mich. Comp. Laws § 418 | Most employees, including minors | Required | Workers’ Disability Compensation Agency |

| Ohio | Ohio Rev. Code Ann. § 4123 | Nearly all employees | Required, state-run system | Bureau of Workers’ Compensation |

| Wisconsin | Wis. Stat. ch. 102 | Most employees; farm exemptions | Required | Department of Workforce Development |

| Iowa | Iowa Code ch. 85 | Most employees; some exclusions | Required | Division of Workers’ Compensation |

| Kansas | Kan. Stat. Ann. § 44-501 | Most employees | Required | Division of Workers’ Compensation |

| Minnesota | Minn. Stat. ch. 176 | Nearly all employees | Required | Department of Labor and Industry |

| Missouri | Mo. Rev. Stat. ch. 287 | Most employees; construction-specific rules | Required | Division of Workers’ Compensation |

| Nebraska | Neb. Rev. Stat. § 48-101 | Nearly all employees | Required | Workers’ Compensation Court |

| North Dakota | N.D. Cent. Code § 65 | Nearly all workers | Required, monopolistic state fund | Workforce Safety & Insurance |

| South Dakota | S.D. Codified Laws § 62 | Most employees; agricultural exemptions | Required, with exceptions | Department of Labor and Regulation |

Regional trends: Waiting periods across the Midwest range from 3 to 7 days before wage benefits begin. Most states require workers to give notice within 30 days, though filing deadlines often extend to 2 years. Ohio, North Dakota, and Wyoming remain among the few U.S. states with monopolistic systems, where employers must obtain insurance exclusively from the state. South Dakota stands out for allowing certain employers to elect coverage, leaving some workers with limited protections.

Workers’ Compensation Law Variations Across the Western States

Western states impose broad coverage requirements but apply different eligibility rules and claim administration processes. California extends protection even to undocumented employees, while Washington and Wyoming restrict coverage to state-run systems. Employers across the region face strict penalties for failing to insure workers.

Western Region: Workers’ Compensation Laws by State (2026)

| State | Workers’ Comp Statute | Coverage Scope | Employer Mandate | Governing Agency |

|---|---|---|---|---|

| Arizona | A.R.S. Title 23 | Nearly all employees | Required | Industrial Commission of Arizona |

| Colorado | Colo. Rev. Stat. § 8-40 | Most employees; excludes casual labor and farm work | Required | Division of Workers’ Compensation |

| Idaho | Idaho Code Title 72 | Nearly all employees | Required | Industrial Commission |

| Montana | Mont. Code Ann. Title 39, Ch. 71 | Most employees; contractor exemptions | Required | Department of Labor & Industry |

| Nevada | Nev. Rev. Stat. ch. 616A | Nearly all employees | Required | Division of Industrial Relations |

| New Mexico | N.M. Stat. Ann. § 52-1 | Most employees | Required | Workers’ Compensation Administration |

| Utah | Utah Code Ann. § 34A-2 | Nearly all employees | Required | Labor Commission |

| Wyoming | Wyo. Stat. Ann. § 27-14 | Most employees | Required, monopolistic state fund | Department of Workforce Services |

| Alaska | Alaska Stat. § 23.30 | Nearly all employees | Required | Workers’ Compensation Board |

| California | Cal. Lab. Code § 3200 | Nearly all employees, including undocumented workers | Required | Division of Workers’ Compensation (DWC) |

| Hawaii | Haw. Rev. Stat. ch. 386 | Most employees | Required | Disability Compensation Division |

| Oregon | Or. Rev. Stat. ch. 656 | Nearly all employees | Required | Workers’ Compensation Division |

| Washington | RCW Title 51 | Nearly all employees | Required, state-run system | Department of Labor & Industries |

Regional trends: Waiting periods in Western states typically fall between 3 and 7 days, with injury notice deadlines ranging from 30 to 60 days. California is notable for extending coverage regardless of immigration status and for its complex medical dispute resolution process. Washington and Wyoming operate exclusive state-run funds, leaving employers without private market options. These variations make compliance critical, as uninsured employers often face heavy fines and liability exposure.

How the Law Office of Roy Yang Guides California Workers’ Compensation Cases?

California applies some of the nation’s strictest workers’ comp rules, and navigating the system without legal help often results in denied or delayed benefits. The Law Office of Roy Yang represents injured workers at every stage of the claim, ensuring compliance with California statutes and full protection of employee rights.

Key steps in the claims process include:

- Filing and Case Initiation: Preparing and submitting the Application for Adjudication of Claim with the Workers’ Compensation Appeals Board (WCAB).

- Medical Evidence Collection: Coordinating evaluations, securing medical reports, and resolving disputes about treatment or disability ratings.

- Hearing Representation: Advocating for injured workers in conferences, hearings, and trials before the WCAB.

- Appeals and Petitions: Filing petitions for reconsideration when benefits are denied or limited.

- Settlement Review: Drafting and reviewing Compromise & Release agreements or Stipulations to guarantee compliance with California law.

Clients are kept informed of deadlines and rights at every stage, while the legal team manages the complex filings, hearings, and negotiations. Injured workers can review details about available workers’ comp benefits before filing, and our experienced workers’ compensation lawyers guide each case on a contingency basis. Consultations are free, and no fees are owed unless benefits are secured.

Workers’ Compensation Coverage for Out-of-State and Multi-State Employees

Employees who work across state lines or on remote assignments often face unique challenges when seeking workers’ compensation. Jurisdiction depends on contract location, principal place of employment, and the state where the injury occurred. Employers operating in more than one jurisdiction are frequently required to maintain coverage in multiple states to stay compliant.

Common scenarios include:

- Remote Workers: Coverage usually applies in the state where the employee primarily performs work, even if the employer is located elsewhere.

- Multi-State Travel: Injuries during business travel may trigger overlapping jurisdiction between the home state and the state of injury. Claims often depend on each state’s extraterritorial provisions.

- Temporary Assignments: Workers temporarily placed in another state may still file in their home state, though some jurisdictions require reciprocal agreements or special endorsements to ensure coverage.

Cross-border operations create high risk for disputes if insurance is not properly structured. Employers must verify policy endorsements before sending employees out of state, and workers should confirm where claims can be filed to avoid delays in benefits.

Tax and Benefit Implications of Workers’ Compensation Laws

At the federal level, most workers’ comp benefits are not taxed as income. The main exception occurs when benefits overlap with Social Security Disability Insurance (SSDI), which may make part of the payment count as taxable workers’ compensation benefits. Interest on delayed settlements can also be taxable.

At the state level, medical treatment and reimbursement for injury-related expenses are consistently tax-free. Some states, however, draw distinctions between temporary wage replacement and permanent disability payments. Certain jurisdictions also require workers to report benefits, even when those payments remain exempt.

Understanding these rules helps employees avoid unexpected tax liabilities and ensures compliance with both state and federal reporting requirements.

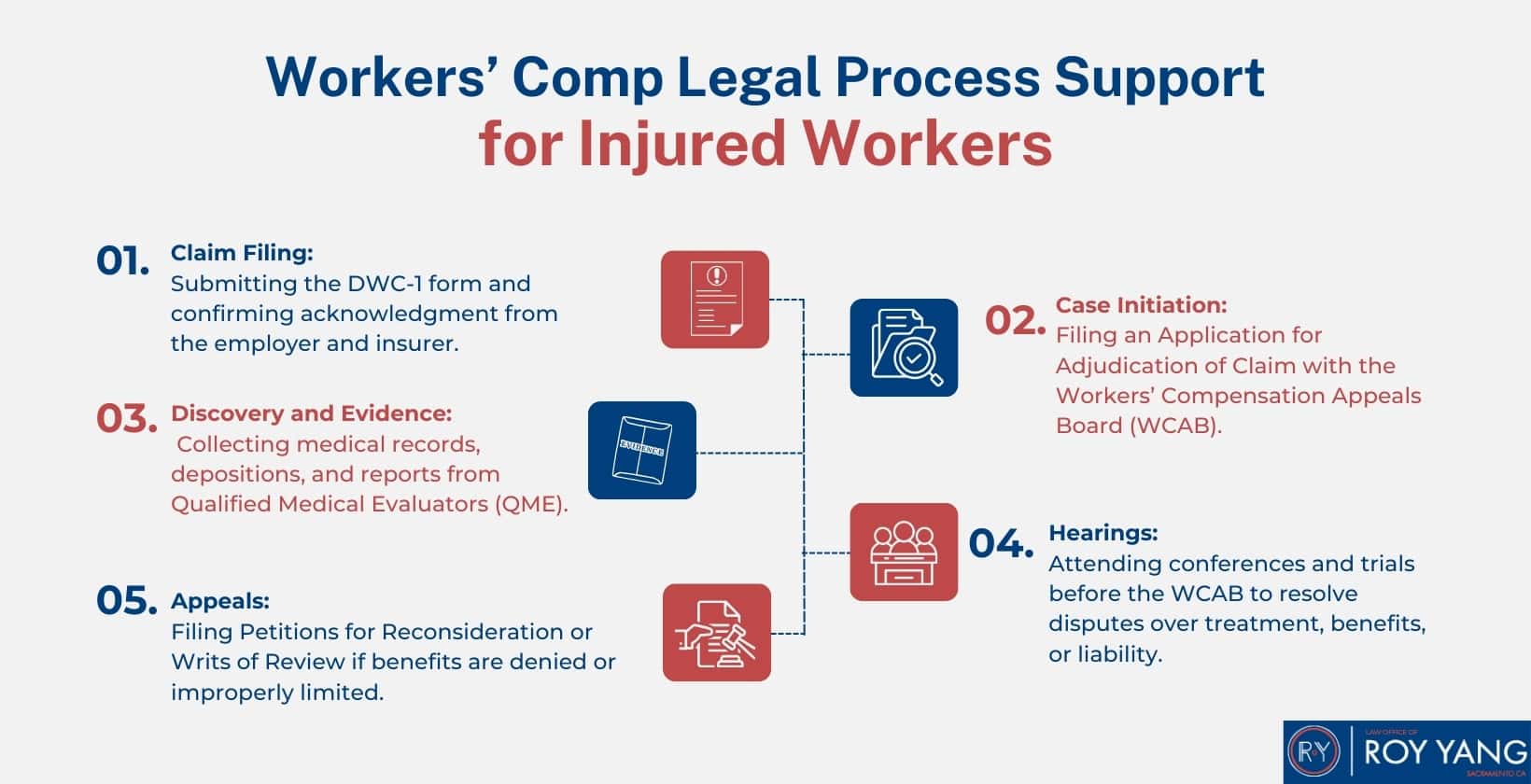

Legal Process Support for Workers’ Comp in California

California’s workers’ comp claim process follows strict procedural steps that must be completed on time. Missing a deadline or form requirement often results in delayed or denied benefits. Legal guidance ensures the claim stays on track from start to finish.

Workers’ Comp Legal Process Support for Injured Workers

- Claim Filing: Submitting the DWC-1 form and confirming acknowledgment from the employer and insurer.

- Case Initiation: Filing an Application for Adjudication of Claim with the Workers’ Compensation Appeals Board (WCAB).

- Discovery and Evidence: Collecting medical records, depositions, and reports from Qualified Medical Evaluators (QME).

- Hearings: Attending conferences and trials before the WCAB to resolve disputes over treatment, benefits, or liability.

- Appeals: Filing Petitions for Reconsideration or Writs of Review if benefits are denied or improperly limited.

Each step requires strict compliance with California law. An attorney manages deadlines, handles disputes, and negotiates settlements, allowing injured workers to focus on recovery while preserving their rights to full compensation.

FAQs on Workers’ Compensation Laws Across U.S. States

What is the Workers’ Compensation Act in the United States?

The Workers’ Compensation Act in the United States is a set of laws requiring employers to provide insurance for work injuries. The Act ensures medical treatment, wage replacement, and limits employer liability for lawsuits related to workplace accidents.

How does workers’ compensation operate under state laws?

Workers’ comp operates under state laws by defining eligibility, benefit scope, and claims. Each state sets its own statute, deadlines, and agency oversight, so workers’ compensation under state laws varies significantly across jurisdictions.

Is workers’ compensation law the same as disability insurance?

No, workers’ compensation law is not the same as disability insurance. Workers’ compensation law covers job-related injuries, while disability insurance covers non-work conditions. They differ in eligibility, benefit duration, and how coverage is funded.

Do state laws cover remote workers under workers’ comp?

Yes, state laws cover remote workers under workers’ comp if the injury is job-related. Coverage for remote workers depends on contract location, employer base, and where the employee primarily performs work duties.

Can employees claim compensation for work travel injuries?

Yes, employees can claim compensation for work travel injuries if travel is within job duties. Work travel injuries may be covered for business trips, employer errands, or driving between assignments under state workers’ comp laws.

Are workers’ comp benefits taxable in any state?

Workers’ comp benefits are generally not taxable in any state. Workers’ comp benefits remain tax-free under federal law, except when combined with Social Security Disability Insurance, which may make part of the benefits taxable.

Do all states require workers’ compensation posters in the workplace?

No, not all states require workers’ compensation posters in the workplace. Most states mandate workers’ comp posters, but Texas differs by allowing optional coverage. Posters provide claim instructions, deadlines, and carrier contact details to employees.

Posters provide employees with claim instructions, deadlines, and insurance carrier contact information. Noncompliance may result in penalties for the employer.

Are undocumented workers covered under any state workers' comp laws?

Yes, undocumented workers are covered under state workers’ comp laws in jurisdictions such as California and New York. Undocumented workers may receive medical treatment and wage replacement despite immigration status under state workers’ compensation laws.

Does workers’ comp cover occupational diseases in every state?

Yes, workers’ comp covers occupational diseases in every state, but coverage definitions vary. Some states restrict occupational diseases to specific job exposures, while others apply broader interpretations of illness linked to workplace conditions.

Can an employee sue their employer instead of filing for workers’ compensation?

No, an employee cannot usually sue their employer instead of filing for workers’ compensation. The exclusive remedy rule applies, unless the employer intentionally caused harm or failed to carry required workers’ compensation insurance.

What happens if a state changes its workers’ compensation laws?

If a state changes its workers’ compensation laws, new rules govern future claims. Workers’ compensation laws usually keep existing claims under old statutes unless legislators make the changes retroactive.

How State-Level Workers’ Compensation Laws Continue to Evolve in 2026?

State legislatures continue to adjust workers’ compensation laws in response to workplace changes. In 2026, states expanded coverage for occupational diseases, added protections for remote employees, and revised benefit formulas to reflect updated wage structures. Many states also increased penalties for uninsured employers and moved toward electronic claim filing.

If you are facing issues with a denied or delayed claim, the Law Office of Roy Yang can help protect your rights. Start with a free consultation through our consultation form.