Worker comp fraud costs honest workers and employers millions across California. When someone lies, hides facts, or fakes an injury to gain or avoid benefits, they damage the system for everyone. In California, it’s a felony, punishable by prison, fines up to $150,000, and repayment of any wrongfully obtained benefits.

Whether you’re being accused or suspect someone else, understanding what fraud looks like and how to respond is essential to protect your rights. No one should suffer because of another person’s dishonesty. Roy Yang is here to make sure that doesn’t happen to you.

Key Takeaways

- Workers’ Compensation Fraud in California involves falsifying claims, punishable by severe fines and prison sentences.

- Red Flags for fraud include inconsistent injury reports, delayed reporting, and avoiding medical tests.

- Investigation takes 30-90 days, including document reviews, interviews, and sometimes surveillance.

- Fraud can be reported anonymously through the California Department of Insurance or the insurance fraud unit.

- Preventing Fraud requires strict internal controls, injury monitoring, and employee education on consequences.

- Consequences of Fraud include criminal charges, fines up to $150,000, and repayment of benefits.

- Legal Help is essential for defending against fraud allegations, appealing denials, and handling retaliation.

Understanding Workers' Compensation Fraud

Workers’ compensation fraud is a serious issue with legal, financial, and ethical consequences. To understand how to respond or prevent it, we must first define it and identify who is most likely to commit it.

What Is Workers’ Comp Fraud?

Workers’ compensation fraud happens when someone gives false or incomplete information to get or avoid paying benefits. This includes:

- Faking injuries

- Misclassifying workers

- Inflating bills

- Wrongfully denying claims

Fraud can occur at any step in the process and often requires an investigation to prove intent.

Who Commits Workers' Comp Fraud?

Fraud can be committed by:

- Claimants: Faking or exaggerating injuries, or working secretly while receiving benefits.

- Employers: Misclassifying employees or denying valid claims to lower premiums.

- Medical Providers: Billing for unneeded services or creating fake medical records.

- Attorneys: Coaching clients or filing exaggerated claims for gain.

- Insurers: Delaying or denying legitimate claims to save money.

Each party may have a different motive, but the damage is shared by everyone.

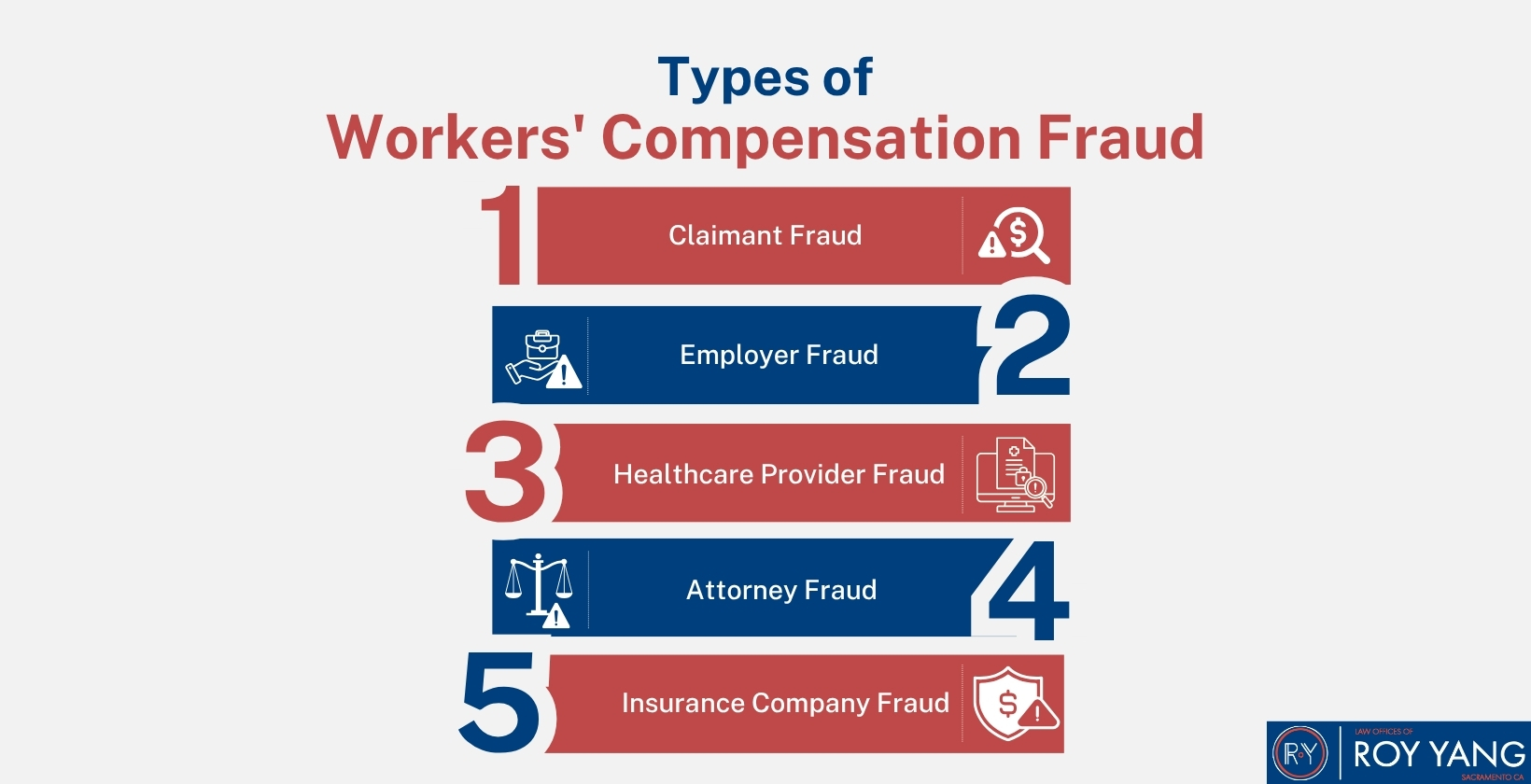

Types of Workers' Compensation Fraud

Fraud occurs in multiple forms, depending on the role of the person involved. Below are the key categories that outline how different parties abuse the system.

Claimant Fraud

Claimant fraud involves employees who deceive the system to collect undeserved benefits. Common tactics include:

- Faking or exaggerating injuries.

- Claiming injuries that occurred outside of work.

- Engaging in unreported employment while on disability.

Employer Fraud

Employers commit fraud by manipulating information to reduce costs:

- Misclassifying employees as independent contractors.

- Underreporting payroll.

- Denying legitimate claims or discouraging workers from filing.

Healthcare Provider Fraud

Provider fraud includes deceptive practices by medical professionals:

- Billing for unperformed or unnecessary treatments.

- Inflating service costs.

- Creating false medical documentation to support fraudulent claims.

Attorney Fraud

Attorneys may:

- File false or exaggerated claims.

- Coach clients on how to manipulate the system.

- Accept illegal referral payments or participate in fraud rings.

Insurance Company Fraud

Insurance fraud involves bad-faith tactics by carriers:

- Wrongfully denying valid claims.

- Delaying benefit payouts to reduce liability.

- Misleading claimants or avoiding legitimate financial responsibility.

How Workers' Comp Fraud Happens?

Fraud can arise at any point during a workers’ comp case. Understanding how it plays out in real cases helps stakeholders recognize it early.

Common Scenarios and Real-World Examples

Here’s how fraud appears in real life:

- An employee claims an unwitnessed injury, but is later seen engaging in physical labor elsewhere.

- An employer classifies warehouse staff as office clerks to cut costs.

- A doctor charges for therapy sessions that never happened.

- A lawyer files duplicate claims with inflated injuries for multiple clients.

These examples show why early detection is so important.

The Impact of Workers' Comp Fraud

Fraud doesn’t just affect companies—it impacts you, your coworkers, and your ability to get fair benefits.

- For Workers: Legitimate claims get delayed, denied, or heavily scrutinized.

- For Employers: Premiums increase, audits intensify, and lawsuits may follow.

- For the System: Fraud clogs the courts and consumes resources meant for real injuries.

Everyone pays the price when fraud goes unchecked.

Warning Signs and Red Flags of Fraud

Recognizing red flags can help employers, insurers, and providers identify fraud before it escalates.

Delayed Reporting

Injuries reported days or weeks after the incident, without a valid explanation, often signal fraud. Prompt reporting is a legal requirement and critical to the claim process.

Inconsistent Medical Reports

Discrepancies between reported symptoms and medical documentation or diagnosis changes over time may indicate exaggeration or fabrication.

Exaggerated or Repetitive Claims

Frequent or overly severe claims, particularly from the same employee, require scrutiny. Claims unsupported by job duties or injury severity should be investigated.

Witness Discrepancies

Conflicting witness accounts or a lack of witnesses entirely can suggest the reported event did not occur as claimed.

Social Media Clues

Posts or photos showing physical activity inconsistent with the claimed injury can provide strong evidence of fraud.

Detecting and Investigating Workers' Comp Fraud

Detection involves a combination of human observation, technological tools, and procedural enforcement.

Detection Methods (Surveillance, Audits, Data)

- Surveillance confirms whether a claimant’s physical activities match reported limitations.

- Audits identify discrepancies in payroll, medical billing, and claims history.

- Data analytics reveal patterns such as repeated claims, duplicate billing, or unusual reporting trends.

Role of Employers & Insurers

Employers must maintain proper documentation, report claims accurately, and cooperate with investigations. Insurers are responsible for initiating fraud reviews, deploying field investigators, and working with state agencies.

Investigation Timelines

Most investigations take 30 to 90 days. They include claim file reviews, interviews, record analysis, and in some cases, physical surveillance. Findings are forwarded to the appropriate legal authority if fraud is substantiated.

How to Report Workers' Compensation Fraud?

Reporting is a shared responsibility. Whether you’re an employer, employee, or third-party observer, timely and well-documented reports, as well as how to report, matter.

Reporting to Insurance Providers

Start by contacting your insurance carrier’s fraud unit. Provide specific details, including claim numbers, names, dates, and behavior that appears inconsistent or dishonest.

State Agencies (e.g., California Department of Insurance)

California’s Department of Insurance accepts fraud reports through an online portal or fraud hotline. The agency investigates and refers cases for criminal prosecution where appropriate.

Anonymous Reporting Tools (Hotlines, Online Portals)

To protect whistleblowers, California permits anonymous reporting. Secure hotlines and web forms ensure your identity is not disclosed.

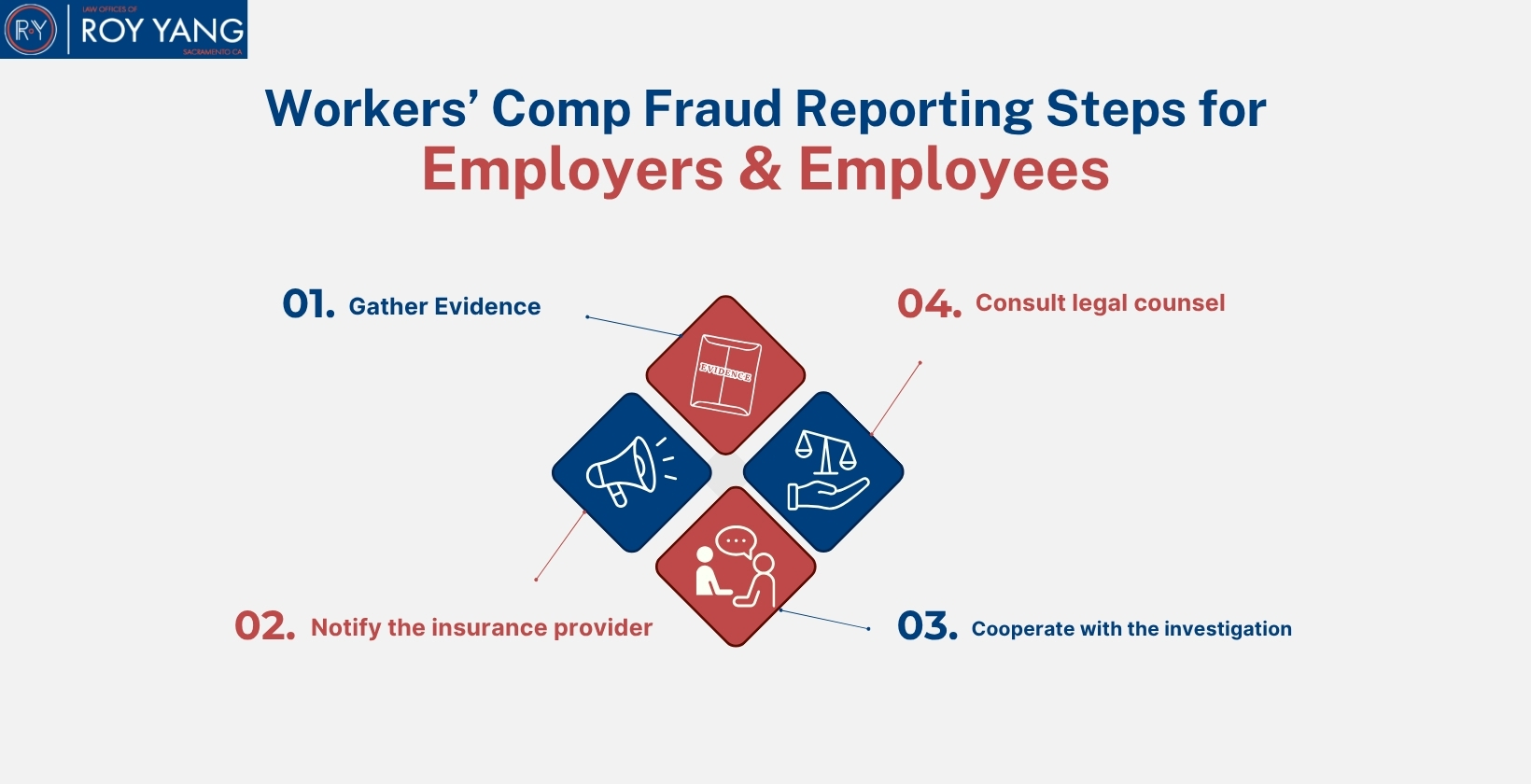

Steps for Employers & Employees

- Gather Evidence: Claim details, inconsistencies, and supporting documents.

- Notify the insurance provider or the Department of Insurance.

- Cooperate with the investigation.

- Consult legal counsel to protect your rights if involved.

Workers’ Comp Fraud Reporting Steps for Employers & Employees:

Legal Consequences of Workers’ Compensation Fraud

California imposes severe penalties for fraudulent workers’ compensation activity, including financial penalties and imprisonment.

For Employees

- Termination of employment

- Criminal prosecution and felony charges

- Repayment of benefits

- Fines and potential imprisonment

For Employers

- Civil penalties and lawsuits

- Criminal charges for payroll or classification fraud

- Suspension of workers’ comp coverage

For Medical Providers

- License revocation

- Fines and criminal charges

- Exclusion from future claims participation

Civil Lawsuits & Criminal Liability

Fraud can lead to criminal convictions and civil suits from insurers or harmed parties. Penalties may include prison, restitution, fines, and reputational damage.

How to Prevent Workers’ Comp Fraud?

Prevention involves vigilance, process, and education at every level—from hiring and training to claims handling and legal compliance.

For Employers: Audits, Training, Accurate Classification

- Conduct internal payroll audits

- Train staff on accurate reporting and injury documentation

- Ensure correct worker classification to avoid misreporting premiums

For Employees: Transparency, Medical Compliance

- Report injuries immediately and truthfully

- Follow medical treatment plans and restrictions

For Providers: Ethical Billing & Treatment

- Bill only for actual services rendered

- Avoid overdiagnosing or unnecessary treatment

Compliance Culture and Fraud Prevention Policies

Establish strong internal policies against fraud, promote a culture of transparency, and ensure employees understand the legal consequences of fraudulent activity.

How to Protect Yourself from False Allegations?

Being falsely accused can feel overwhelming. But there are steps you can take to protect yourself from the start:

Document Everything

Keep copies of medical records, communicate with your employer or insurer, and keep all documentation of your injury and recovery.

Follow the Process

Adhere to deadlines, treatment plans, and communication protocols. This protects your case from being questioned or denied unfairly.

Get Legal Help Early

If you suspect you’re being accused or are under investigation, hire a workers’ comp attorney immediately.

Avoid Online Missteps

Stay off social media during your claim period. Posts showing physical activity can be misinterpreted and used as evidence.

Suspecting Fraud? Here's What to Do

If you believe someone’s committing fraud, you don’t have to act alone, but you should act responsibly.

- Evidence Collection: Compile names, claim details, medical records, dates, and photos or witness accounts that support your suspicion.

- Whistleblower Protections: California law protects you from retaliation for reporting fraud in good faith. If your job is threatened after reporting, legal remedies are available.

- Legal Consultation: Before making an allegation, consult with a qualified attorney. Legal guidance ensures your report is handled properly and without exposing you to liability.

Taking action helps the system and protects you from future harm.

The Role of Legal Professionals in Workers' Comp Fraud Cases

Retaining California bar-certified legal help is essential if you are under investigation, accused of fraud, or facing employer retaliation after a claim. A workers’ comp attorney can protect your rights and guide you in your next steps.

- Explain your rights if you are accused of workers’ comp fraud

- Challenge denied benefits or appeal fraud-related claim decisions

- Represent you during investigations by insurers or state fraud units

- Protect you from employer retaliation after reporting an injury

- Help gather strong evidence to defend your claim

Negotiate penalties or settlements tied to fraud allegations - Ensure legal compliance if you are planning to return to work

How the Law Offices of Roy Yang Can Help?

The Law Offices of Roy Yang helps clients by delivering focused, strategic support backed by over 15 years of workers’ compensation experience in Sacramento and across Northern and Central California. We bring passion, diligence, and results to every case, especially when fraud allegations or complex disputes arise.

- Proven Litigation Record: We have successfully defended California workers across numerous industries in high-stakes hearings, appeals, and fraud investigations.

- Fraud-Specific Strategies: Our approach is built for the unique challenges of fraud defense in your specific industry and work role, not one-size-fits-all claims handling.

- Personal, one-on-one guidance: You will always be heard, supported, and advised directly by our firm’s leadership, not passed off or overlooked.

At Offices of the Roy Yang, we don’t just defend claims; we help injured workers construct a path to justice. Contact us for your free consultation today.

FAQs on Workers’ Comp Fraud

How common is workers’ comp fraud?

It occurs more often than reported, with billions lost annually in the U.S. through fraudulent claims, misclassifications, and inflated billing.

Can I be accused without evidence?

You can be suspected, but legal action requires credible evidence such as surveillance, conflicting reports, or inconsistent behavior.

Is workers’ comp fraud felony in California?

Yes. California classifies workers’ comp fraud as a felony punishable by fines, imprisonment, and restitution under Insurance Code § 1871.4.

Will fraud affect my legitimate claim?

Yes. Fraudulent claims lead to stricter claim evaluations, increased delays, and higher denial rates even for honest workers.

What if fraud is discovered after a payout?

The person responsible will be required to repay all benefits and may face criminal prosecution, fines, and civil litigation.