Workers compensation benefits in California protect employees injured or made ill by their jobs. These valuable benefits cover medical care, including doctor visits and rehabilitation, and provide wage replacement for lost income during recovery.

Disability benefits are available based on the severity of the injury, and job retraining support is offered if the employee cannot return to their previous role. In cases of death, dependents may receive financial assistance and funeral expenses.

Despite these protections, many workers are unaware of their entitlements, leading to delayed claims or denied benefits. Understanding your rights under California workers’ compensation laws is crucial to ensure you receive the full support to which you are entitled.

Key Takeaways

- Types of Benefits: California workers’ comp offers medical care, rehab, temporary/permanent disability benefits, vocational training, lost wages, and mental health coverage.

- Disability Coverage:

- Temporary Disability – for short-term work loss.

- Permanent Disability – for long-term or lifetime impairments.

- Partial vs. Total – depends on the severity and impact on work.

- Eligibility: Most employees injured at work are covered, regardless of immigration status or length of employment.

- Filing a Claim: Requires prompt reporting, medical documentation, and claim form submission (DWC-1).

- Benefit Calculations: Based on wages, injury severity, and recovery outlook, includes Average Weekly Wage (AWW) and Permanent Disability Rating.

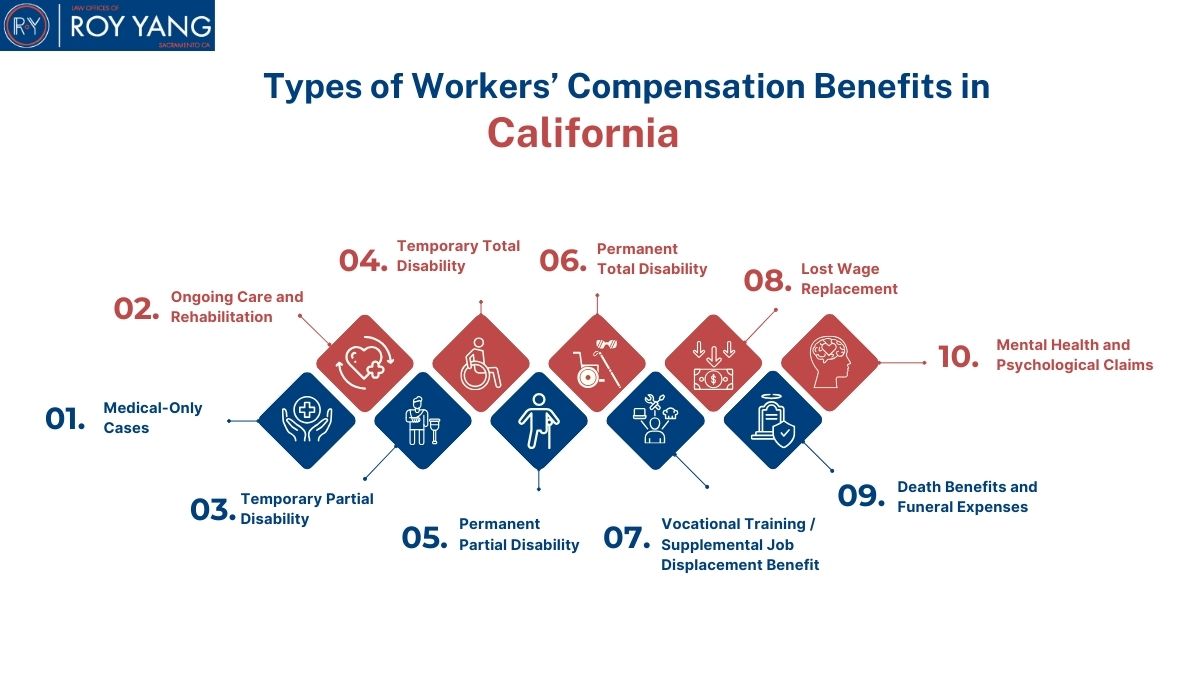

Types of Workers’ Compensation Benefits in California

California provides 10 main types of workers’ compensation benefits. These vary depending on injury severity, work restrictions, and recovery time.

1. Medical-Only Cases

Medical-only cases apply when you sustain a work-related injury or illness that requires treatment but does not cause you to miss any workdays. While wage replacement is not included, you are still entitled to have your medical expenses covered. To ensure your claim is accepted, it is important to provide clear and accurate documentation proving that your injury is work-related.

2. Ongoing Care and Rehabilitation

If your work-related injury requires long-term medical attention, you may be eligible for ongoing care and rehabilitation benefits. These typically cover services such as physical therapy, occupational therapy, and pain management. Consistent follow-up care is essential—it not only supports your full recovery but also helps prevent long-term complications or permanent disability. Ensuring you receive the appropriate treatment can make a significant difference in your ability to return to work and maintain quality of life.

3. Temporary Partial Disability

Temporary Partial Disability (TPD) benefits apply when you are able to return to work after an injury, but only in a limited capacity or at reduced hours, resulting in lower earnings than before. These benefits help bridge the gap by partially compensating for the difference between your pre-injury wages and your current earnings during recovery.

4. Temporary Total Disability

Temporary Total Disability (TTD) benefits are available if you find yourself completely unable to work for a limited period due to a work-related injury or illness. TTD typically pays about two-thirds of your average weekly wage (AWW) and can be provided for up to 104 weeks within a five-year period. These benefits offer essential financial support while you focus on recovery and prepare to return to work.

5. Permanent Partial Disability

Permanent Partial Disability (PPD) benefits apply when you suffer a lasting injury that limits your ability to work but does not completely prevent you from working. These benefits are determined based on a state-assigned disability rating, which reflects the severity of your impairment and its impact on your future earning capacity. PPD helps compensate you for the long-term effects of your injury, even if you are eventually able to return to work in a different or reduced role.

6. Permanent Total Disability

Permanent Total Disability (PTD) benefits are reserved for the most severe cases—when your work-related injury or illness prevents you from ever returning to any type of employment. If you are determined to be eligible, you may receive lifetime wage replacement based on your average weekly wage (AWW), along with ongoing medical treatment. PTD ensures long-term financial and medical support for those facing permanent and complete loss of earning capacity.

7. Vocational Training / Supplemental Job Displacement Benefit

If you are unable to return to your previous job due to a work-related injury, the Supplemental Job Displacement Benefit provides a non-transferable voucher to help you retrain for a new career. This voucher can be used to cover expenses such as online courses, licensing fees, books, and career counseling, giving you the tools and support needed to reenter the workforce in a different capacity.

8. Lost Wage Replacement

Lost wage replacement benefits compensate you for income lost due to a temporary or permanent work-related disability. These payments generally amount to two-thirds of your average weekly wage (AWW) and are adjusted based on whether you are able to return to work, either fully, partially, or not at all. This support helps you maintain financial stability while recovering or adapting to long-term limitations.

9. Death Benefits and Funeral Expenses

If a work-related injury or illness results in death, workers’ compensation provides death benefits to surviving dependents, such as a spouse, children, or other eligible family members. These benefits include coverage for funeral expenses and ongoing financial support through regular payments. The total benefit amount depends on the number of dependents, ensuring their loved ones receive the assistance they need during a difficult time.

10. Mental Health and Psychological Claims

Workers’ compensation in California also covers legitimate mental health conditions such as PTSD, anxiety, or chronic stress resulting from the workplace. To qualify, you must demonstrate that work was a significant contributing factor to your condition. Thanks to evolving legal standards and recent court rulings, eligibility for psychological claims has expanded, offering critical support for mental well-being in the workplace.

Who Is Eligible for Workers’ Compensation Benefits?

All employees in California are eligible for workers’ compensation benefits if they are injured or become ill due to their job duties. The state requires coverage regardless of employment type or immigration status.

The primary categories of eligible workers in California include:

- Full-Time Employees: Automatically covered under California law. Benefits include medical treatment, wage replacement, and rehabilitation for work-related injuries or illnesses.

- Part-Time Employees: Covered if injured while performing approved work tasks. California law does not exclude workers based on part-time status.

- Seasonal Workers: Covered during active periods of employment, typically defined by seasonal contracts. If an injury occurs during this time, full benefits are available.

- Undocumented Workers: Covered under California’s workers’ compensation system. Immigration status does not affect access to medical care and wage loss benefits for job-related injuries.

How Long Must I Be Employed to Qualify for Workers’ Comp?

In California, you are eligible for workers’ compensation benefits from your very first day on the job. There is no minimum length of employment required. As long as your employer carries workers’ compensation insurance—and nearly all employers are legally required to do so—you are covered, whether you worked for one hour, one day, or several years.

This immediate coverage applies to all types of workers, including:

- Full-time and part-time employees

- Seasonal and temporary workers

- New hires and probationary employees

If you suffer a job-related injury or illness, whether from a slip and fall, lifting accident, or a repetitive motion injury, you have the right to receive medical care, wage replacement, and other applicable benefits under the California workers’ compensation system.

If you are unsure whether your injury qualifies, speaking with a workers’ compensation attorney can help clarify your rights and ensure you receive the support you deserve.

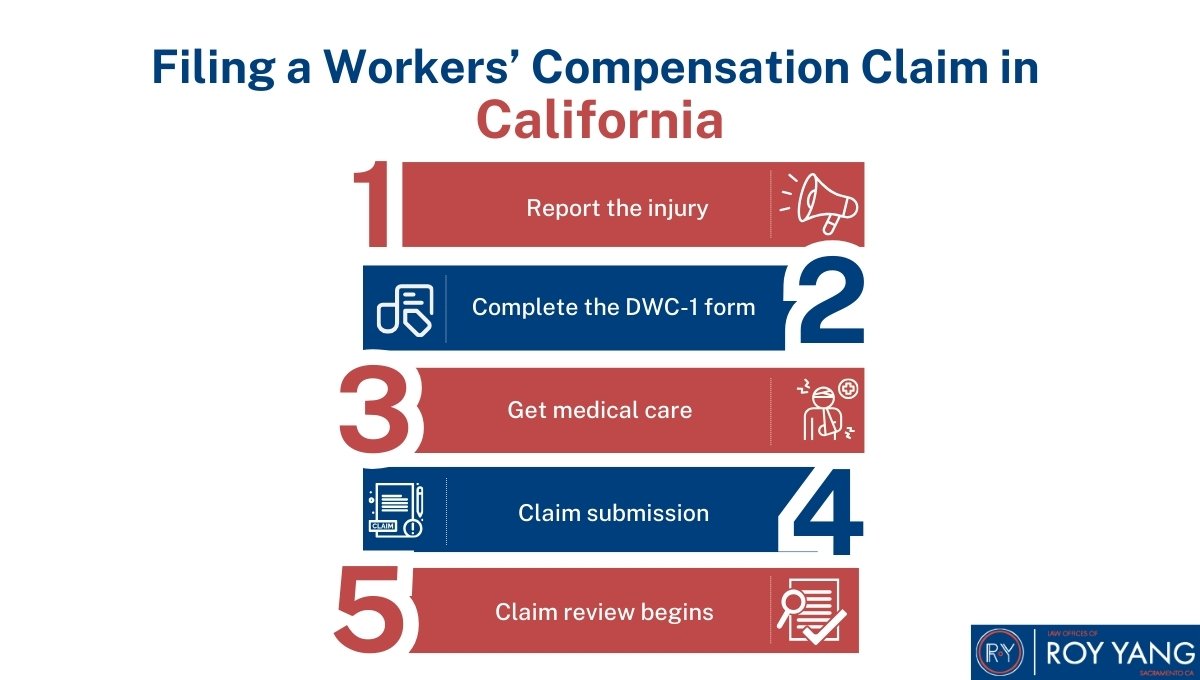

Filing a Workers’ Compensation Claim in California

Filing a workers’ compensation claim in California is a step-by-step process that ensures you obtain the medical care and benefits that you are entitled to receive. Acting quickly is essential to protect your rights.

- Report the Injury: Notify your employer immediately. State law requires notice within 30 days of the injury or diagnosis.

- Complete the DWC-1 form: Request and fill out the official Workers’ Compensation Claim Form. Return it to your employer without delay.

- Get Medical Care: Visit a doctor within your employer’s approved network. The first visit documents your work injury.

- Claim Submission: Your employer sends the completed form to their workers’ compensation insurance carrier.

- Claim Review Begins: Your employer sends your completed form to their workers’ compensation insurance carrier.

For a more detailed walkthrough, review this guide on how to file a workers’ compensation claim, including timelines, documentation tips, and what to expect during the claims process.

How Workers’ Compensation Benefits Are Calculated?

The benefits of workers’ comp in California are calculated based on three factors: the worker’s average weekly wage (AWW), the type of disability, and the impairment rating assigned by a medical professional.

These values determine how much a worker receives and for how long.

AWW and Wage Loss Formulas

Average Weekly Wage (AWW) is calculated from a worker’s gross earnings before the injury. Most temporary disability benefits are equal to two-thirds of the AWW, up to the annual state maximum.

Example: If your AWW is $1,200, your weekly benefit is about $800, unless limited by the maximum cap.

How Disability Ratings Affect Payment?

Disability ratings are used to calculate permanent disability payments in California. Doctors assign a percentage based on the severity of your long-term impairment. This rating affects how much you receive and how long benefits last. Ratings are adjusted based on:

- Age

- Occupation

- Diminished earning capacity

Example: If you receive a 15% permanent disability rating, you may be eligible for around 77 weeks of payments, with weekly benefits averaging approximately $315. That would result in a total benefit of roughly $24,255. Actual payments may vary depending on your wages before the injury and any updates to state compensation rates.

Understanding your disability rating is crucial as it directly impacts your financial support moving forward.

State Minimum and Maximum Payout Caps

California sets annual limits on weekly workers’ compensation benefits for temporary total disability.

As of 2024:

- Maximum: $1680.29 per week

- Minimum: $252.03 per week

These caps maintain consistency while reflecting wage differences across industries and job types.

Denied or Delayed Workers’ Compensation Benefits

Not all claims are approved right away. Delays and denials often happen due to late filing, insufficient medical documentation, or disputes over how the injury occurred.

Timeline for Claim Review and Approval

- Insurance companies in California have 14 days to accept, deny, or delay a workers’ compensation claim after it is filed.

- Medical records and reports, such as doctor’s notes and imaging results, play a key role in this decision.

- If no decision is made, the insurer must begin temporary benefits while the review continues.

Common Reasons Claims Get Denied or Delayed

There are 5 common reasons a claim might be delayed or denied:

- Your injury was not reported within the 30-day time frame.

- Your injury is not clearly work-related.

- Your case has incomplete or inconsistent medical documentation.

- Your case contains disputes between parties over how the injury occurred.

- Your pain was caused by a pre-existing condition and was not worsened by work.

What to Do If Your Benefits Are Delayed?

Take these 4 steps if your claim is under review:

- Contact your claims adjuster for an update on the review status.

- Submit a Declaration of Readiness (DOR) to request a hearing with the Workers’ Compensation Appeals Board.

- Ask for a QME (Qualified Medical Evaluator) if there are conflicting medical opinions.

- Keep detailed records of communication, paperwork, and treatment.

How to Appeal a Denied Workers’ Comp Claim?

- File an Application for Adjudication of Claim with the Workers’ Compensation Appeals Board (WCAB).

- Request a mandatory settlement conference to discuss your case.

- Prepare for trial if the dispute is not resolved through settlement.

- You may represent yourself or hire a workers’ compensation lawyer to advocate on your behalf throughout the process.

How a Workers’ Compensation Lawyer Can Help Your Claim?

A workers’ compensation lawyer can make a significant difference in denied, delayed, or disputed claims.

They manage workers’ comp appeals, gather medical evidence, manage legal filings, and protect you from retaliation.

When to Hire a Workers’ Compensation Attorney?

While many workers’ compensation claims are straightforward, certain situations call for more detailed legal support to protect your rights and ensure fair treatment. You should consider hiring a workers’ compensation attorney if:

- Your claim has been denied or unreasonably delayed.

- Your employer has retaliated against you for reporting your injury.

- There is a disagreement over your permanent disability rating.

- Your injury is complex, such as involving multiple body parts or resulting in long-term impairments.

An experienced attorney can help you navigate the system, gather the necessary evidence, and advocate for the full benefits you deserve.

Why Choose Law Office of Roy Yang for Your Case?

At the Law Offices of Roy Yang, we increase your chances of recovering full benefits by combining strategic legal representation with personalized client care. Our firm is built on decades of experience, a strong success rate in California workers’ compensation cases, and a commitment to fighting for injured workers every step of the way, including appeals and complex claim management.

Here are 3 essential legal strengths we bring to your case:

- Negotiation: We work directly with insurance companies to secure maximum compensation and avoid unnecessary delays.

- Litigation: If needed, we are fully prepared to represent you in hearings and trials, ensuring your voice is heard.

- Investigation: We build a solid case by gathering medical evidence, witness statements, and liability documentation tailored to your situation.

From denied claims to disputed disability ratings, our legal strategy is designed to protect your rights and secure the outcome you deserve. We handle every case on a contingency fee basis-you pay nothing unless we win.

Book your free consultation today and let us help you take the next step toward the benefits you’re entitled to.

What Are Third-Party Claims?

Third-party claims arise when a party other than your employer is legally responsible for your work-related injury. While workers’ compensation provides benefits for medical treatment and partial wage replacement, it does not cover the full extent of your losses, such as pain and suffering, emotional distress, or full loss of future earnings.

If you suspect you might have been injured due to the negligence or wrongdoing of someone outside your employer’s control, you may have the right to file a third-party lawsuit. This type of claim allows you to pursue additional compensation that goes beyond the limits of workers’ comp benefits.

You may be eligible to file a third-party claim in situations such as:

- Defective equipment or machinery causing injury on the job.

- Negligence by subcontractors or third-party vendors on multi-employer job sites.

- Motor vehicle accidents that occur while driving for work-related purposes.

If you believe a third party contributed to your injury, it is important to get an examination and opinion from a qualified attorney. You could be entitled to significantly more compensation than workers’ comp alone can provide.

When Third-Party Claims Apply (Examples)

- Ex. 1: A power tool malfunctions and injures your hand → You sue the manufacturer.

- Ex. 2: A subcontractor leaves debris onsite, forgetting to clean up → You trip and fall.

- You’re in a car accident while driving for your employer to a work-related meeting → The other driver is liable.

Third-Party Claims vs. Workers’ Compensation

| Feature | Workers Compensation | Third-Party Claim |

|---|---|---|

| Fault Required? | No | Yes - must prove third-party negligence |

| What Can You Recover | Medical bills, lost wages, and disability benefits | Full damages, including pain and suffering, future lost wages |

| Who Pays? | Employer’s Insurance | Third-party (individual or company) |

| Time Limit to File | Typically, 1 year from the date of injury | Generally, 2 years under civil law |

You can pursue both a workers’ comp claim and a third-party lawsuit at the same time, but benefits are coordinated to avoid duplicate payments.

Your Rights as an Injured Worker in California

- Medical Care: You have the right to immediate, employer-paid treatment for work-related injuries.

- Wage Replacement: You can receive disability benefits if you are unable to work.

- Protection from Retaliation: It is illegal for your employer to punish you for filing a claim.

- Legal Representation: You may hire a workers’ compensation lawyer at any point; fees come from your settlement, not from your own pocket.

FAQs Related to Workers’ Comp. Benefits

Is there a waiting period for workers’ comp coverage?

No, there is no waiting period for workers’ compensation coverage in California. While medical treatment is available immediately, wage replacement benefits typically begin after a 3-day waiting period, unless you remain hospitalized or unable to work for more than 14 days. In this case, you may be compensated for those initial days as well.

Does working part-time affect my benefits?

No, part-time workers are fully eligible for workers’ comp. However, your benefits are based on your actual wages, so the payout reflects your part-time income, not a full-time salary.

Can I work while receiving workers’ comp benefits?

Yes, you can work while receiving workers’ comp benefits if your doctor clears you for light or modified duty. If you earn less than before, you may still receive partial wage replacement. Returning to full-duty work may end your wage benefits.

Is it illegal for an employer not to have workers’ comp in California?

Yes. California law requires all employers to carry valid and comprehensive workers’ compensation insurance, even those with just one employee. Employers who fail to comply face penalties, lawsuits, and potential criminal charges.

Can I sue for pain and suffering outside workers’ comp?

No, you cannot sue for pain and suffering outside workers’ comp under workers’ compensation. The system does not cover pain and suffering. However, if a third party (like a subcontractor or equipment manufacturer) caused your injury, you can file a separate civil lawsuit for full damages.