A fatal work-related injury doesn’t just take a human life. It takes a major toll on loved ones, leaving a family without income, stability, or the answers they deserve. During such an overwhelming time, understanding your legal rights becomes critical to moving past the tragedy. In California, workers’ compensation death benefits can help cover funeral expenses, replace lost wages, and provide long-term support for dependents.

But not every death qualifies, and not every family member is eligible. The amount paid out depends on strict California laws, and unfortunately, many families do not find out about the limitations until their claim is denied.

If you’ve recently lost a loved one to a tragic work incident, this page will help you understand your rights. You will learn what benefits may be available, who is legally eligible to receive them, and how California defines a work-related death. In moments like this, finding clarity is of the utmost importance, and knowing what the law says can be the first step toward finding, consultation, stability, and ultimately justice.

Key Takeaways

- Workers’ compensation death benefits provide financial support to dependents after a job-related death, covering funeral costs and lost wages.

- California law defines eligible dependents as spouses, minor children, disabled adult children, and partial dependents with proven financial reliance.

- Benefit amounts range from $250,000 to $320,000, plus up to $10,000 for funeral expenses, and are paid weekly or as a lump sum.

- Claims must be filed within one year of death, with notice to the employer required within 30 days.

- Legal representation is often crucial in securing full benefits, especially for denied, delayed, or disputed claims.

What Are Workers’ Compensation Death Benefits?

Workers’ compensation death benefits provide financial support to families after a work-related death. These benefits are paid to a spouse, children, or other dependents who relied on the worker’s income.

These benefits follow strict rules under California law. The type and amount of support depend on the relationship to the deceased and the circumstances of the death.

Unlike life insurance, these benefits apply only when the death is job-related and are set by state law, not by a private policy.

Each part of this benefit serves a different need after the loss.

Funeral and Burial Coverage

Under California law, workers’ compensation provides up to $10,000 to cover funeral and burial expenses after a work-related death.

Covered costs may include:

- Funeral home charges

- Burial or cremation

- Transportation of the body

The employer’s insurance company pays this amount.

The employer’s insurance pays this benefit, and they must issue payment within 60 days of receiving the bill. Doing so is meant to ease the immediate financial burden on your family during an already difficult time.

Wage Replacement for Dependents

Once eligibility is confirmed, California workers’ compensation law provides weekly wage replacement benefits to qualifying dependents.

These payments are:

- Two-thirds of the worker’s average weekly wage

- Payout amount capped at the state’s maximum allowable amount

- Paid in steady increments over time until the total benefit limit is reached

Longer-term support may apply if the dependent is a child under 18 or a disabled adult unable to work.

As your attorney, we help you calculate exactly what your family is entitled to earn, and make sure you receive it without delay or denial.

Who Qualifies for Workers’ Compensation Death Benefits?

Workers’ compensation death benefits are available to family members who depended on the deceased worker for financial support. California law defines these family members as “dependents” and groups them based on how much support they received.

Once eligibility is confirmed, the amount and duration of benefits are determined based on dependency status and wage calculations.

Total Dependents

Total dependents are those who completely relied on the worker for financial support. Under California law, they are presumed eligible without needing to prove dependency.

They are:

- A spouse with no income

- A child under 18

- A disabled adult child who can’t work

Partial Dependents

Partial dependents are family members who receive some support from the worker but are not fully financially reliant. These individuals must provide documentation to show that support was being provided at the time of death.

They may include:

- An adult child in college receiving rent or tuition support

- A parent sharing housing or utility bills

- A stepchild provided with food or shelter

How Do I Know If I’m Eligible for Death Benefits?

If you’re unsure whether you qualify, this quick checklist can help.

- You lived in California or relied on someone who worked here

- You are related by blood, marriage, or adoption

- You received financial support (money, housing, care)

- You can provide documentation to show that the worker consistently provided support before their passing.

When Is a Work-Related Death Covered?

Under California law, a death is considered work-related and therefore eligible for workers’ compensation benefits when it is directly caused by the employee’s job duties or working conditions. This includes sudden workplace accidents and medical events or long-term exposure that can be clearly linked to the nature of the work.

California workers’ compensation laws cover these scenarios:

- A fatal fall on a construction site

- Exposure to toxic chemicals or hazardous materials on the job

- A heart attack triggered by extreme physical or emotional stress at work

In these cases, because the job played a direct role in causing the death, workers’ compensation benefits apply.

However, not every death is automatically covered. California follows the “coming and going” rule, which generally excludes coverage for fatalities that happen during a regular commute. An exception may apply if the employee was traveling as part of their job or under the employer’s instruction.

Additionally, deaths that occur during personal errands, off-duty activities, or for reasons unrelated to the job are typically not covered.

Every situation is fact-specific. If you’re unsure whether your loved one’s death qualifies, we can help you understand how the law applies and what options your family has for pursuing benefits.

What Does Workers’ Compensation Cover After a Fatality?

If the death is covered, survivors may receive the following:

- Wage Replacement: Based on the worker’s past earnings

- Funeral and Burial Reimbursement: Up to $10,000 in California

- No pain and Suffering: These damages are not allowed in workers’ comp claims

The amount paid depends on the worker’s income and the number of qualified dependents.

How Much Do Dependents Receive in Death Benefits?

In California, workers’ death benefits amount varies based on the number of dependents.

Benefit Amount by Dependent Type

The amount your family may receive depends on your relationship to the worker and how many dependents are eligible. California law sets the following maximum benefit amounts for death claims:

- Spouse Only: $250,000

- Spouse and One Child: $290,000

- Spouse and Two or More children: $320,000

These figures represent the total benefits allocated among the eligible dependents.

How Long Do Death Benefits Last?

The duration of death benefit payments depends on the dependent’s status:

- Spouse: Payments continue until remarriage.

- Children: Payments continue until they reach 18 years of age.

- Disabled Dependents: In certain cases, benefits may continue for life if the dependent is disabled.

These provisions ensure that dependents receive support for a specified period following the worker’s death.

How Are Workers’ Compensation Death Benefits Paid?

Workers’ compensation death benefits are paid by the employer’s insurance company. Payments go to eligible dependents after a work-related death.

Benefits are usually issued in weekly or biweekly payments. A lump sum may be available if both sides agree and the claim qualifies.

The insurance company handles all payments. Payments begin once eligibility is confirmed.

Lump Sum vs. Ongoing Payments

A lump sum provides immediate full payment (when approved) for large expenses but offers no future income. Ongoing payments deliver regular installments (standard for most cases), ensuring steady income but delaying full access. Choose lump sum for urgent needs and ongoing payments for long-term stability.

Key Differences:

| Factor | Lump Sum | Ongoing Payments |

|---|---|---|

| Speed | Immediate payout | Paid gradually over time |

| Income type | One-time payment | Consistent, sustained income |

| Best for | Urgent needs or large expenses | Covering long-term living |

How to File for Death Benefits in California?

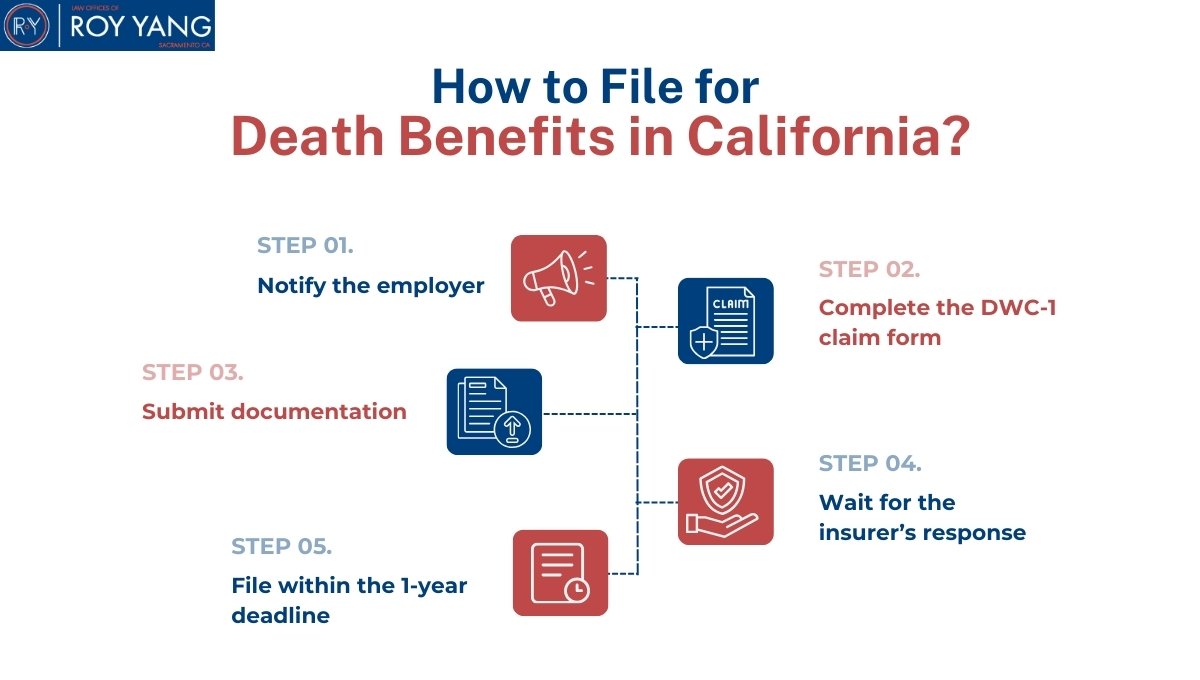

To receive workers’ compensation death benefits in California, eligible dependents must follow a formal claim process. Below are the official steps:

- Step 1: Notify the Employer

Report the worker’s death to their employer as soon as possible. Notice must be given within 30 days to preserve the right to file a claim. - Step 2: Complete the DWC-1 Claim Form

Request a DWC-1 form (Workers’ Compensation Claim Form) from the employer or insurer. Fill it out and return it to the employer. This form officially starts the claim. - Step 3: Submit Documentation

Provide a death certificate, proof of dependency (such as marriage license or birth certificates), and documents showing financial support. - Step 4: Wait for the Insurer’s Response

The insurance company will review the claim. They may ask for more documents before approving or denying benefits. - Step 5: File Within the 1-Year Deadline

A death benefits claim must be filed within one year of the worker’s death under California Labor Code § 5406.

Why You Should Hire a Workers’ Comp Death Benefits Attorney?

A workers’ comp death benefits attorney is the steady hand that guides families through the multi-step claim process after a work-related death.

These claims often involve complications such as:

- Denied claims by the insurance company

- Disputes over dependent status

- Delayed or reduced payments

Hiring a lawyer improves your chances of receiving the full compensation allowed by California law. An attorney:

- Prepares and submits all required documents

- Appeals denials with supporting evidence

- Builds proof of dependency when needed

- Handles insurer communication to avoid stalling

A firm experienced in workers’ compensation law manages every legal step, helps separate logic from emotion, and protects your rights throughout the process.

When Hiring a Death Benefits Attorney Makes a Difference?

Some claims involve legal or financial risks that make an hiring attorney essential.

Legal help matters when:

- The case involves multiple dependents with unclear claims

- The insurer demands proof of financial support

- Prior claims were rejected or underpaid

- The process is delayed beyond legal deadlines

- The family is unsure how to respond to insurer requests

In complex or high-stakes cases, having an experienced death benefits attorney on your side is critical.

We will protect your rights, handle the paperwork and deadlines, and advocate for the full benefits your family is legally entitled to expect under California law.

FAQs: Workers Compensation Death Benefits

What happens if your spouse dies at work?

If your spouse dies due to a job-related cause, you may qualify for workers’ compensation death benefits. You must prove dependency and file a claim within one year of the worker’s death.

How much does workers’ comp pay?

Workers’ compensation death benefits in California range from $250,000 to $320,000, based on the number of dependents. Weekly payments must not be less than $224, and funeral costs may be reimbursed up to $10,000.

Do I get more from workers’ comp or disability?

Workers’ comp usually pays more than disability after a work-related death. Workers’ comp offers tax-free lump sums and weekly payments. Disability benefits are smaller sums paid out monthly and apply only when survivors are disabled.

How long do I have to file for death benefits?

California law requires filing a death benefits claim within one year of the worker’s death.

Do death benefits differ by state?

Yes, death benefit amounts differ across states. California offers one of the highest maximum payouts at $320,000, plus $10,000 for funeral costs. States like Texas and New York have lower or income-based benefit caps.

What are the 5 types of state workers’ compensation benefits?

Workers’ compensation provides five key benefits: medical treatment for work-related injuries, wage replacement during recovery (temporary disability), compensation for lasting impairments (permanent disability), job retraining if needed (vocational rehabilitation), and death benefits for fatal workplace incidents covering funeral costs and survivor support.

How the Law Offices of Roy Yang Supports Families After Workplace Deaths?

Roy Yang is a respected member of the Northern California law community who combines expert legal strategy with honest, genuine empathy for our Sacramento area neighbors. The firm protects families, represents their interests, and works to recover every benefit they are owed. The firm believes its professional legal services should clear the path forward and secure every benefit allowed by law, so that families can focus on processing their grief and healing as quickly and as fully as possible.

In these extremely difficult moments, you do not have to face your bereaved’s employer or the California justice system alone. Schedule your consultation and let us handle and alleviate the legal burdens.