Most people think of a work injury happening at a job site or in a company vehicle, but the reality has shifted dramatically. With so many Californians now working remotely, a question we often hear is: “Does workers’ comp cover me if I get hurt while working from home?”

The short answer is yes. California Labor Code Division 4 ensures that employees are protected by the state’s system. This means that workers’ compensation for remote workers applies whether you are in a home office, a coffee shop, or a co-working space, giving you the same legal right to benefits for a job-related injury as those in a traditional office setting.

The key is proving that your injury “arose out of and in the course of your employment.” To understand this, it is essential to know what kind of employees qualify for workers’ compensation for remote workers in California.

Key Takeaways

- Remote and telecommuting workers are typically covered under workers’ compensation (workers’ comp or workman’s comp) if injuries occur during work duties.

- Your injuries could qualify for workers’ compensation when they arise directly from job-related tasks, even in a home office.

- Small businesses that operate from home with remote workers must maintain valid workers’ comp coverage for eligible employees.

- Contractors and freelancers usually do not qualify for workers’ comp, since they are classified as independent workers.

- Workers’ compensation provides replacement income and medical benefits to remote employees injured in the course of employment.

- Legal help is essential-a skilled workers’ comp lawyer can protect your rights and handle your claim effectively. Contact the expert team at The Law Office of Roy Yang for trusted legal support.

Who Qualifies for Workers’ Compensation in California While Working Remotely?

California workers’ compensation coverage covers all employees, regardless of where they perform their work, provided the injury is work-related and occurs during regular working hours.

If you are classified as an employee under state law, and you suffer an injury while carrying out job-related duties, you likely qualify for workers’ compensation benefits. The law focuses on your status as a worker and applies equally to remote, hybrid, or on-site roles.

Does the Same Law Apply to Telecommuting and Off-Site Workers?

Yes. California workers’ compensation law applies equally to telecommuting and off-site employees. This is known as a “location-neutral” policy interpretation, meaning you don’t need to be in a company office or even at home to be eligible. The system reviews off-site and telecommuting injury workers’ comp claims under the same legal standard as injuries at traditional job sites.

For example, an employee working from a rented desk at a coworking space trips over a power cord during a scheduled video conference. Since the activity occurred during active work hours and involved job-related tasks, the injury is likely compensable under California law.

What Work Arrangements Still Qualify as “Employment”?

Most working arrangements qualify for workers’ compensation, as long as the worker is legally considered an employee. This applies to full-time, part-time, temporary, and even undocumented workers. However, independent contractors generally do not qualify. California uses the “ABC test” to determine if a worker is an employee or an independent contractor.

Here’s how different remote work setups are typically classified:

| Work Arrangement | Covered as an Employee? |

|---|---|

| Full-time Remote Staff | Yes. Fully eligible under standard employment. |

| Part-time Remote Staff | Yes. Hours don't limit coverage. |

| 1099 Independent Contractor | No (unless misclassified). |

| Freelancers With Set Hours and Gig Workers | Generally classified as independent contractors and not eligible. |

Many workers are misclassified, and that impacts remote workers’ compensation eligibility, benefits access, and employer liability. Use the ABC test to determine true status, or consult a workers’ compensation lawyer to understand if you qualify as an employee in California workers’ comp.

Are Employers Legally Required to Cover Remote Workers?

Yes, California employers are legally obligated to provide workers’ compensation insurance for all employees, including those working remotely. This is mandated by California Labor Code §3700, which requires any business with at least one employee to maintain valid workers’ compensation insurance, regardless of whether the employee works on-site or off-site.

Do Employers Need Coverage for Hybrid Employees Too?

Yes, employers must also cover hybrid workers (those who split their time between home and on-site locations) under California workers’ compensation law. A mixed work setting does not allow employers to prorate or limit coverage based on the frequency of the employeeis physical presence.

Employers must list hybrid employees accurately in their insurance classification and payroll reports or risk non-compliance penalty issues.

What Are the Penalties for Noncompliance?

If an employer fails to bear valid workers’ comp coverage for remote workers, they can face serious penalties under California Labor Code §3700.5.

Here’s what noncompliance can trigger:

- Civil fines up to $100,000

- Criminal misdemeanor charges with possible jail time

- State-issued stop-work orders halting all operations

- Employee lawsuits for uncovered medical bills, lost wages, and penalties

If a remote worker suffers a home office injury and the employer doesn’t have coverage, the employer may become personally liable for the full cost of treatment, lost wages, and permanent disability.

How Often Must Remote Coverage Be Reviewed or Updated?

California employers must review remote coverage at least once a year, or any time job duties, employee classifications, or work locations change.

Employers are subject to workers’ comp audit requirements in California by the Workers’ Compensation Insurance Rating Bureau (WCIRB). These updates ensure correct employee classifications, payroll reporting, and accurate premium calculations.

Are Remote Employees Covered If They Work Out of State?

Yes, California workers’ comp covers remote employees working out of state, but only if certain legal connections to California exist. If the employee has a valid California connection, such as being hired in California or working under a California-based supervisor, the injury may be handled under California workers’ comp jurisdiction.

Workers’ comp for out-of-state employees is usually complex because it depends on jurisdiction, employment contracts, tax reporting, and how much control the California employer exercises over the worker’s day-to-day duties.

How Does California Determine Jurisdiction for Remote Workers?

California determines jurisdiction based on several legal and factual factors. A remote worker may fall under California workers’ comp law if:

- They were hired in California, even if they now live elsewhere

- Their employer is located in California

- They perform work that primarily benefits a California-based business

- Their payroll is reported in California

- The employer exercises ongoing direction or control from within California

For example, a remote graphic designer is hired in Los Angeles but later moves to Oregon. If their supervisor, payroll, and project oversight are all California-based, California retains jurisdiction. However, workers’ comp benefits may not apply if the employee was hired in another state, never works in California, and reports to out-of-state management.

| Category | Federal (OWCP) | California (DWC) |

|---|---|---|

| Provider Choice | Must use OWCP-approved providers | Employer chooses first 30 days, then the injured worker must stay within the MPN |

| Treatment Authorization | Must be pre-authorized by OWCP; strict review process | Must pass utilization review (UR); delays are common |

| Second Opinion Rights | Allowed, but only with OWCP approval | Injured workers may seek second opinion within the network |

| Dispute Resolution | OWCP-controlled; no outside judicial review | Disputes go to a Qualified Medical Evaluator (QME) or Independent Medical Review |

What Injuries Are Covered When Working from Home?

While the physical location is different, the same general workers’ comp laws apply to injuries employees sustain in the course and scope of employment as they would in a traditional office setting. This covers both sudden accidents and cumulative trauma injuries.

To clarify what’s covered, the table below compares examples of compensable vs. non-compensable work-from-home injuries:

| Category | Covered Injuries (Compensable) | Not Covered Injuries (Not Compensable) |

|---|---|---|

| Slips and Falls | Slipping on the floor while getting work documents | Tripping while getting a snack during personal time |

| Repetitive Strain Injuries (RSIs) | Repetitive stress injury from typing work reports | Injury while folding laundry between tasks |

| Moving Work Equipment | Back strain from lifting a company-issued printer or chair | Muscle pull from rearranging personal furniture during a break |

| Work-related Stress or Mental Health Conditions | Diagnosed job-related anxiety supported by medical records and workload evidence | Generalized stress unrelated to assigned work duties |

Note: Under the ‘personal comfort doctrine,’ an injury is compensable if the remote worker was engaged in activities essential for their personal comfort or welfare, and these activities were a part of ‘normal working conditions.’

While your employer covers your injuries during the course of your remote employment, the real challenge is proving that the injury was directly tied to your job duties.

How Do You Prove a Remote Injury Was Job-Related?

To prove a remote injury qualifies for workers’ comp, you must show that the injury occurred while performing job-related tasks. The burden of proof is on the employee, and because no supervisors or coworkers are typically present, meeting workers’ comp documentation requirements becomes critical.

The standard is whether the injury happened in the course and scope of employment. This includes proving that:

- The injury occurred during your scheduled work hours.

- You were actively engaged in a task related to your job duties.

- The task you were performing directly benefited your employer.

What Evidence Supports a Remote Work Injury Claim?

Unlike on-site injuries, remote work injury claims require more precise supporting records. The following types of evidence for workers’ comp claims can help establish how to prove a remote injury was work-related:

- Time-stamped messages or emails

- Calendar entries or task logs

- Screenshots of software usage or login records

- Coworker or supervisor messages

- Doctor’s notes on whether it’s consistent with work activities

- Photographs or videos showing physical setups, equipment, or injury scenes

Why Employer Telework Policies Can Influence Claim Outcomes?

An employer’s telecommuting or remote work policy significantly affects how workers’ comp evaluates and validates a claim. A formal telework policy agreement defines expected work hours, approved work tasks, authorized breaks, and equipment/workspace requirements.

If an injury occurs during approved hours while performing assigned work, a clearly written policy supports the claim. On the other hand, vague or missing policies can trigger insurance disputes.

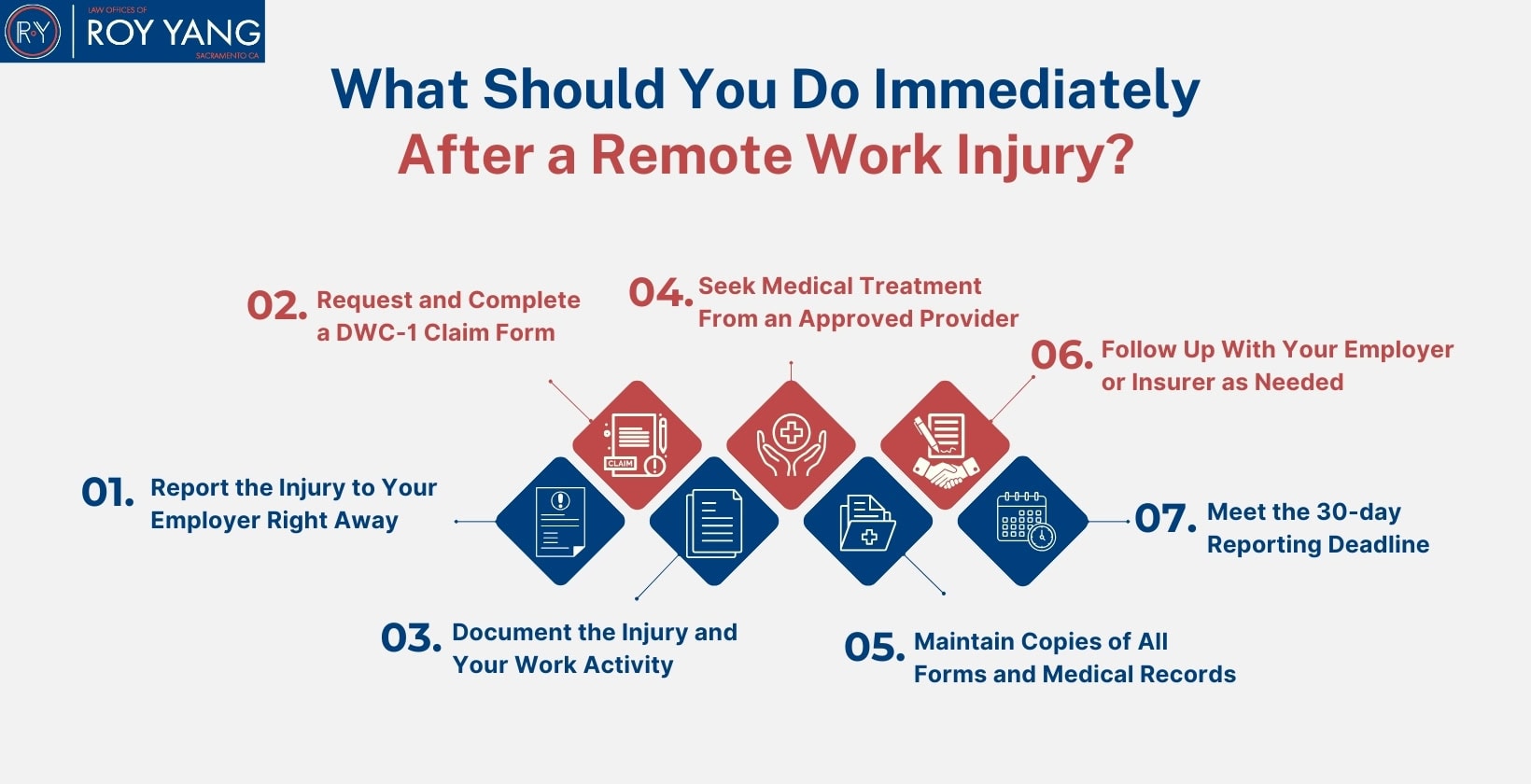

What Should You Do Immediately After a Remote Work Injury?

Remote workers must follow the same steps as on-site employees when reporting a work injury under California law. Timeliness and documentation are critical to protect your benefits and avoid claim denial.

Follow these steps immediately after a remote injury:

- Report the Injury to Your Employer Right Away: Notify your supervisor or HR department the same day. Verbal reports are not enough; always follow up in writing.

Request and Complete a DWC-1 Claim Form: Your employer must provide a DWC-1 form within 1 business day of your report. Complete and return it promptly to start the official claim process.

Document the Injury and Your Work Activity: Save emails, chat logs, screenshots, or any records showing what you were doing at the time.

Seek Medical Treatment From an Approved Provider: Your employer’s workers’ comp insurance will send you to an authorized medical provider. Inform the doctor that your injury is work-related.

Maintain Copies of All Forms and Medical Records: This includes your DWC-1, medical reports, appointment records, and any communication with your employer or claims adjuster.

Follow Up With Your Employer or Insurer as Needed: Track your claim status and respond to any requests for information or clarification.

Meet the 30-day Reporting Deadline: California law requires you to report your injury within 30 days. Missing this deadline could lead to a claim denial.

By reacting promptly and keeping thorough records, you protect your right to receive full California workers’ comp benefits, even as a remote employee.

Can Remote Workers Be Denied Workers’ Compensation Benefits?

Yes, claim administrators can deny a remote employee’s benefits if the injury does not meet legal requirements under California law. While location doesn’t affect eligibility, the injury must still occur during job-related tasks and be properly documented. Failing to do so can result in a workers’ comp denial.

Remote workers’ comp is commonly denied due to the following reasons:

- The injury did not occur during work hours or assigned duties

- There is no witness, insufficient documentation, or proof of the injury

- The injury was reported after the 30-day deadline

- The worker is classified as an independent contractor

Are Employers Responsible for Home Office Safety Conditions?

Yes, under California and federal law, employers are responsible for ensuring the safety and health of remote employees, although the scope of this responsibility is limited. The primary distinction is that in a home office injury, employer liability arises if the employee was performing a task that was assigned, scheduled, or expected as part of their job, but not for the overall safety of the employee’s personal residence.

To reduce risk, many companies implement internal safety protocols for remote staff, such as ergonomic checklists for chairs/screens/desk setups, and formal telework agreements outlining schedules and expectations.

These safeguards not only promote remote workplace safety but also help establish the limits of employer liability and protect both sides in case of injury.

What Workers’ Compensation Classification Codes Apply to Remote Employees?

Workers’ compensation classification codes for remote employees in California are assigned based on job duties by the Workers’ Compensation Insurance Rating Bureau (WCIRB) and directly affect premium rates and audit risk.

The most common code for remote office-based employees is:

| WCIRB Code | Classification Title | Description |

|---|---|---|

| 8871 | Clerical Telecommuter Employees | This classification applies to Clerical Office Employees who work more than 50% of their time at their home or other office space away from any location of their employer. |

Note: 8871 classification requires that the employee not engage in any duties away from their home or telecommuting location, such as deliveries, on-site meetings, or errands.

How Are Remote Workers Evaluated for Disability Ratings?

A medical evaluator evaluates and assigns a disability rating to remote workers in the same way as on-site employees. The evaluation process is standardized under California workers’ compensation law and is typically done by one of the following: A Qualified Medical Evaluator (QME) selected from a state panel or an Agreed Medical Evaluator (AME) chosen jointly by the worker and employer/insurer.

A workers’ comp disability rating process typically includes assigning disability scores based on factors such as:

- Reduced work capacity

- Physical or mental limitations

- Need for future medical care

- Impact on daily living and job tasks

This rating is then converted into a percentage, which directly influences the amount and duration of your workers’ comp temporary or permanent disability benefits.

How Does Workers’ Comp Insurance Handle Long-Term Remote Work?

Workers’ comp insurance treats long-term remote work similarly to traditional employment. However, insurers may periodically re-evaluate risk, benefits, and job responsibilities. Ongoing eligibility for benefits depends on medical status, job modifications, and documentation.

Here’s how long-term remote claims are typically handled:

- Periodic Medical Reviews: If you’re still receiving temporary disability benefits, your treating physician must update your work status regularly. Insurers rely on these reports to continue or end payments.

- Functional Capacity Evaluations (FCEs): In some cases, a doctor may order a formal assessment of your ability to perform work tasks, even in a home-based role.

- Modified Duty or Remote Accommodation Reassessment: The insurer and employer may explore whether you can resume limited duties from home. If so, temporary disability payments may stop.

- Permanent Disability Evaluations: If your condition stabilizes but leaves lasting limitations, you’ll be rated for permanent disability, which may lead to a settlement or ongoing benefits.

How Does Remote Work Affect Compensation Rates or Settlement Value?

Workers’ compensation payouts in California are based on your Average Weekly Wage (AWW) before the injury. If your remote role included variable hours, commissions, or reduced pay, your AWW and your benefits may be lower.

Other factors that influence settlement value include:

- Work capacity, whether you can or cannot return to remote work with restrictions

- Permanent disability rating

- Future earning potential

Insurers may review remote productivity metrics, communication logs, or role changes when assessing claim value.

How California Workers’ Compensation Laws Apply to Remote Workers?

California workers’ compensation laws apply fully to remote employees, as long as they meet the legal definition of an employee under state law.

Key statutes include:

- Labor Code §3600: Establishes that any injury “arising out of and in the course of employment” is covered, regardless of where it occurs.

- Labor Code §3700: Requires all California employers to carry workers’ comp insurance for all employees, including those working from home.

- Labor Code §2750.3 (AB5): Applies the “ABC Test” to determine whether a worker is an employee or an independent contractor, critical for determining coverage eligibility.

In short, the California workers’ compensation laws for remote employees ensure that working remotely does not remove your right to claim benefits if you’re injured on the job.

Is Remote Work Expense Reimbursement the Same as Workers’ Compensation?

No. Remote work expense reimbursement and workers’ compensation are two separate legal obligations under California law. They cover different types of claims and are governed by different statutes.

Workers’ comp, Labor Code §3600, covers job-related injuries and illnesses. Whereas, governed by Labor Code §2802, expense reimbursement covers necessary business-related expenses incurred by employees while working.

| Type of Benefit | Workers’ Compensation | Remote Work Expense Reimbursement |

|---|---|---|

| Type of Benefit | Workers’ Compensation | Remote Work Expense Reimbursement |

| Covers | Work-related injuries or occupational illnesses | Internet, phone, electricity, office supplies, equipment |

| Applies To | Medical care, wage loss, disability, permanent injury | Necessary business expenses incurred while working |

| Claim Process | File DWC-1 and follow injury reporting procedures | Submit receipts or expense reports to the employer |

When Should You Contact a California Workers’ Compensation Attorney?

Not every remote work injury requires legal intervention; however, certain situations make it essential to consult with a workers’ compensation attorney.

Seek legal help in the following scenarios:

- Your claim is denied

- Insurers delay or cut off your benefits early

- You were misclassified as an independent contractor

- You work across multiple states or outside California

- Your injury involves long-term disability or mental health issues

When in doubt about your benefits, classification, or employment status, seeking professional advice early is a safer approach, as it can prevent mistakes from negatively impacting your outcome.

Additionally, if you’re unsure about how to file a workers’ comp claim in California, refer to an experienced California workers’ comp attorney.

Common Myths About Remote Work Injuries and Compensation

The rise of remote work has unfortunately led to an increase in misinformation, particularly concerning workers’ compensation.

Here are common myths, and the realities that counter them:

| Myth | Fact |

|---|---|

| You must have a separate home office. | No. There is no legal requirement for a dedicated office space. What matters is whether the task was work-related. |

| You’re not covered if you use personal equipment. | No. Injuries while using personal laptops, chairs, or supplies are covered if you were performing job duties. |

| Only full-time employees are eligible. | No. Part-time, seasonal, and temporary employees are covered if they are legally classified as employees. |

FAQs: Remote Workers’ Compensation in California

Is mental stress covered under workers' compensation for remote employees?

Yes, mental stress can be a covered injury, but the rules are strict. To be covered, the stress must be a diagnosed psychiatric injury and be caused by specific, work-related events. It must be proven that your job was a substantial cause of the mental stress, not personal issues.

Do I need a designated home office to qualify for workers’ comp?

No, you do not need a designated home office to qualify for workers’ comp. The location of your injury is not the deciding factor. What matters most is that you were performing a work-related task at the time of the injury.

Can I file a claim if I was using personal equipment when injured?

Yes, you can file a claim even if you were using personal equipment. Workers’ compensation covers injuries that arise from your work duties, regardless of whether you are using a work-issued laptop or your own.

Are freelance or 1099 remote workers eligible for workers' comp?

Generally, freelance and 1099 independent contractors are not eligible for workers’ comp. However, if a remote worker has been misclassified as a contractor but should be an employee, they may still be eligible to file a claim.

Can I choose my own doctor after a remote work injury?

Yes, you can choose your own doctor, but with conditions. In California, you have the right to pre-designate a physician in writing before an injury. If you have not done so, your employer or their insurance carrier can direct your initial medical treatment.

How long do I have to report a remote injury in California?

You have up to 30 days to report a remote injury to your employer in California. To protect your claim, however, I strongly recommend reporting the injury immediately, on the same day if possible.

What if I was injured during a Zoom or virtual meeting?

An injury during a virtual meeting is likely covered. If you trip over a cord or have an ergonomic issue while attending a required work meeting, the injury is considered to have occurred in the course of your employment.

Will working from home reduce my compensation amount?

No, working from home will not reduce your compensation amount. Workers’ compensation benefits are calculated based on your average weekly wage, and your physical location has no bearing on this calculation.

What if I was doing personal errands during work hours?

Injuries during personal errands are not covered if they occurred outside the scope of your assigned work duties. If you were injured while doing a personal errand, like taking out the trash or getting a snack, the injury is generally not covered. However, if the errand was a “special errand” for your employer or the injury was a result of a work-related task, it may be covered.

Can I get reimbursed for medical expenses if I didn’t report them immediately?

It depends. While you have 30 days to report the injury, delaying a report can make it more difficult to get your claim accepted and to get compensation. You may get reimbursement if the delay is justified, but failing to report promptly increases the risk of denial.

Unclear About Your Rights After a Remote Injury? Here’s What You Need to Know

It’s normal to feel uncertain after getting injured while working from home, especially when you’re not sure if your injury qualifies or how to prove it. Many remote workers hesitate to report injuries because they’re unsure of their rights or assume they’re not covered.

If you’re uncertain, start by speaking with an experienced California workers’ comp lawyer familiar with the state’s labor codes and laws for remote employees.

Your location doesn’t limit your rights, but what you do next matters. Contact the trusted workers’ compensation lawyer at the Law Office of Roy Yang.