When an employee is injured on the job, they are generally entitled to receive workers’ compensation benefits to cover medical expenses, lost wages, and other related costs. In many cases, the workers’ comp process ends with a workers comp settlement, an agreement between the injured worker and the insurance company to resolve the claim. This settlement can be paid out as a lump sum (a one-time payment) or as structured payments over time. The type of settlement you choose can significantly affect your financial stability, access to care, and legal rights moving forward.

Understanding your settlement options, along with the risks and benefits of each, is essential before making any decision. At the Law Offices of Roy Yang, we bring over 15 years of focused experience in California workers’ compensation law. We take the time to explain your options clearly and help you choose the path that best supports your recovery and long-term financial security.

Key Takeaways

- Your workers comp settlement can be a single lump sum or structured payments over time; each affects your finances and medical coverage differently.

- Key settlement forms include Compromise and Release (C&R) for a final resolution and Stipulated Findings for potential ongoing medical benefits.

- Choosing the right format depends on your injury severity, age, financial obligations, ability to manage funds, and family needs.

- Settlement negotiations happen at various stages, and a workers’ comp attorney is vital to protect your rights and navigate compensation laws.

- Generally, workers’ compensation benefits for physical injuries are not taxable, but exceptions exist for things like punitive damages.

- Making the best settlement decision is complex; seeking help from experienced legal professionals, like our staff at the Law Offices of Roy Yang, is important for becoming fully informed.

What Is a Workers’ Compensation Settlement?

A workers’ compensation settlement is a formal, voluntary agreement between you and the insurance company that resolves your claim after a work-related injury. It outlines the specific amount of compensation you will receive, typically covering medical expenses and a portion of your lost wages. Finalizing a settlement brings clarity and closure to your case. It gives you the ability to move forward with confidence, plan your recovery, and regain control over what comes next in your life.

Who Offers Workers’ Comp Settlements and Why?

Workers’ compensation settlements are typically offered by your employer’s insurance company, not the employer directly. Employers must carry workers’ compensation insurance to cover injuries that occur on the job, and the insurer manages and negotiates these claims.

Insurance companies offer settlements to limit their financial exposure and attempt to bring the claim to a close expediently. For injured workers, a settlement can provide much-needed clarity, stability, and faster access to compensation, often avoiding the stress and delays of a prolonged legal battle.

Understanding why a settlement is offered and whether it meets your long-term needs is key to protecting your rights.

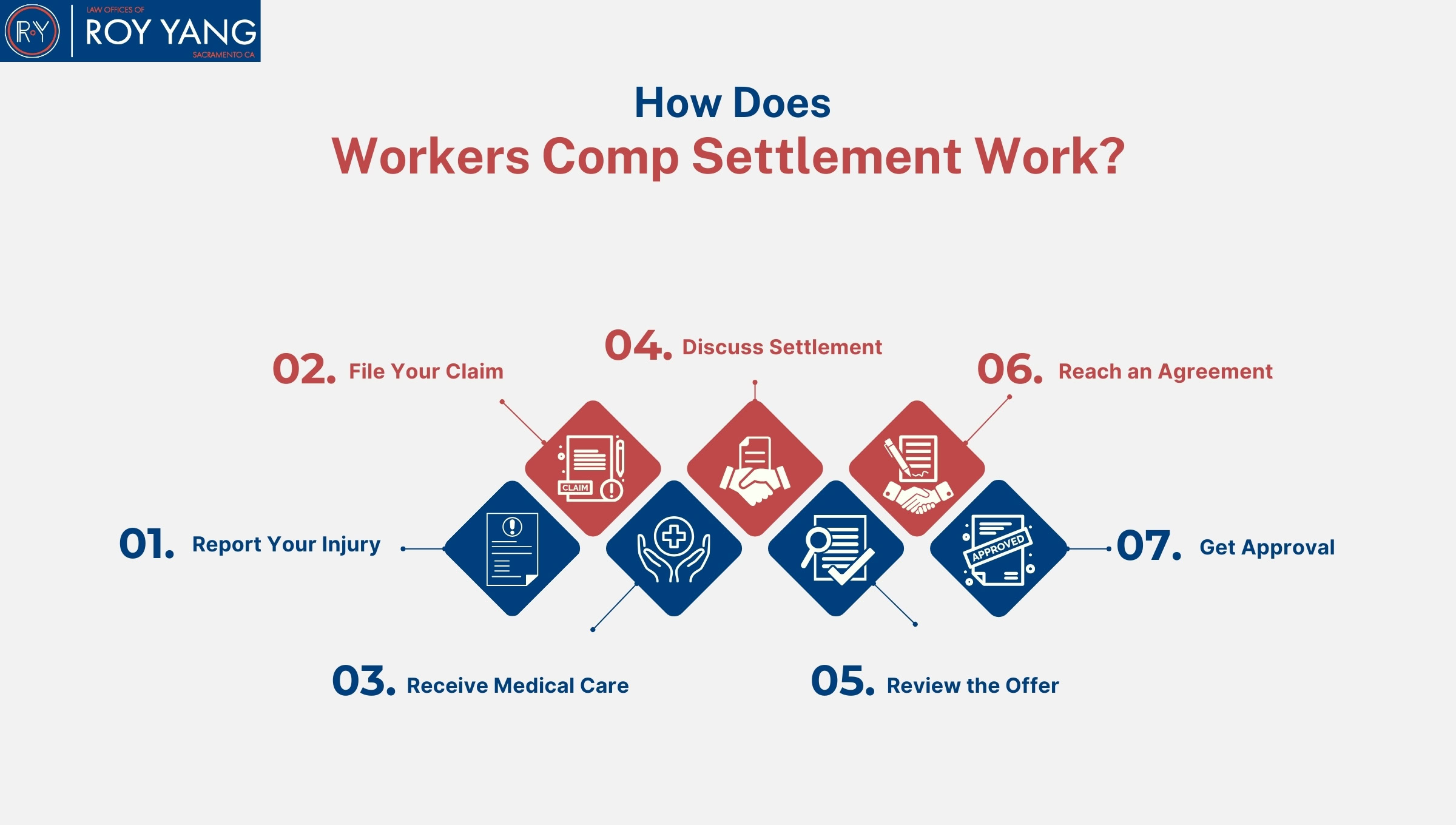

How Does Workers Comp Settlement Work?

The workers’ compensation settlement process involves several key steps, and understanding each one helps you move forward. Here is how it typically works:

- Report Your Injury: Notify your employer as soon as possible, usually via an incident report or other formal written notice.

- File Your Claim: Submit the necessary paperwork to officially begin your workers’ compensation claim.

- Receive Medical Care: Get treatment from an approved medical provider to document and address your injuries.

- Discuss Settlement: Our experienced attorneys will negotiate directly with the insurance company on your behalf.

- Review the Offer: Carefully evaluate any settlement proposal, considering both current needs and future medical costs.

- Reach an Agreement: Once both parties agree on the terms, the settlement is prepared for final approval.

- Get Approval: A workers’ compensation judge must review and approve the settlement to ensure it is fair and legally sound.

Lump Sum vs. Structured Settlement Payments: What’s the Difference?

When you settle your workers’ compensation case, how you receive the money matters just as much as how much you receive. The two main payout options are a lump sum, where you get all the money at once, or structured payments, which are spread out over time.

Each option has its pros and cons, and the right choice depends on your medical needs, financial goals, and future stability. Understanding the difference can help you make a decision that truly supports your recovery.

| Feature | Lump Sum Settlement | Structured Settlement |

|---|---|---|

| Payment Structure | Single, one-time payment | Series of regular payments over a set period |

| Fund Access | Full amount available immediately | Payments received according to a schedule |

| Financial Control | Complete control over all funds at once | Less immediate control; funds managed by an annuity provider |

| Tax Impact | Generally not taxed for physical injury | Payments are generally not taxed for physical injury |

| Medical Cost Planning | You manage all current and future medical expenses | Can include provisions for future medical care |

| Risk Stability | Risk of mismanaging or quickly depleting funds | Provides steady, predictable income |

| Flexibility | High flexibility in how funds are used | Less flexible; the payment schedule is fixed |

| Typical Use Cases | Smaller settlements; clear, limited future needs | Long-term injuries, ongoing care, and lost income |

What’s the Financial Difference?

The key financial difference between a lump sum and structured payments lies in how much control you have over the money, and when you receive it. This impacts everything from budgeting to how you handle unexpected expenses.

- Lump Sum: You receive the full settlement amount upfront, giving you immediate access for large expenses, medical needs, or investments. However, it requires careful long-term budgeting to ensure the money lasts.

- Structured Payments: You receive your settlement in regular installments, making it easier to manage monthly bills and ongoing expenses. While reliable, it may limit your ability to cover large or unexpected costs.

- Emergency Access: A wisely managed lump sum can serve as a financial safety net for emergencies. Structured payments provide steady support, but not the flexibility to address sudden, high-cost needs.

- Budgeting Considerations: Structured payments simplify financial planning with predictable income. A lump sum offers freedom but requires discipline and strategy to avoid running out too soon.

How Do They Cover Medical Costs?

Lump Sum Settlements place full responsibility on you to manage the funds for all current and future medical treatment related to your injury. This gives you flexibility, but also means you bear the risk if future medical costs are higher than expected.

Structured Settlements, on the other hand, can be designed to include a Medical Set-Aside (MSA) or provide ongoing payments earmarked specifically for future treatment. This offers more predictability and protection, especially if you anticipate needing long-term care.

Choosing how your settlement handles medical costs is one of the most important decisions you’ll make. We’re here to help you weigh the risks and secure the support you need for the road ahead.

Which Format Offers Better Stability?

If long-term financial security is your priority, structured settlements typically offer greater stability. With steady, guaranteed payments over time, they reduce the risk of depleting your funds too quickly, something that can happen with a lump sum if not carefully managed.

That said, the right option depends on your personal circumstances. A lump sum gives you full control upfront, which may suit immediate needs or even outside investment plans. On the other hand, structured payments offer you peace of mind that comes with predictable, ongoing support, especially if you’re planning for long-term recovery and income replacement.

Why Eligibility Matters When Filing a Workers’ Comp Claim?

Meeting the eligibility requirements is critical; if you fall short on even one item, your claim could be denied. Before filing, make sure you check all the boxes:

- You are legally classified as an employee.

- The injury occurred while performing work-related duties.

- You reported the injury to your employer within 30 days.

- You followed all required procedures under California workers’ compensation laws.

- If necessary, you received treatment from a medical provider approved by your employer.

Every part of your claim hinges on eligibility. A small oversight can delay or even disqualify you from receiving benefits. For this reason, the wise choice is to consult a workers’ comp attorney early, to avoid costly mistakes and ensure your rights are fully protected.

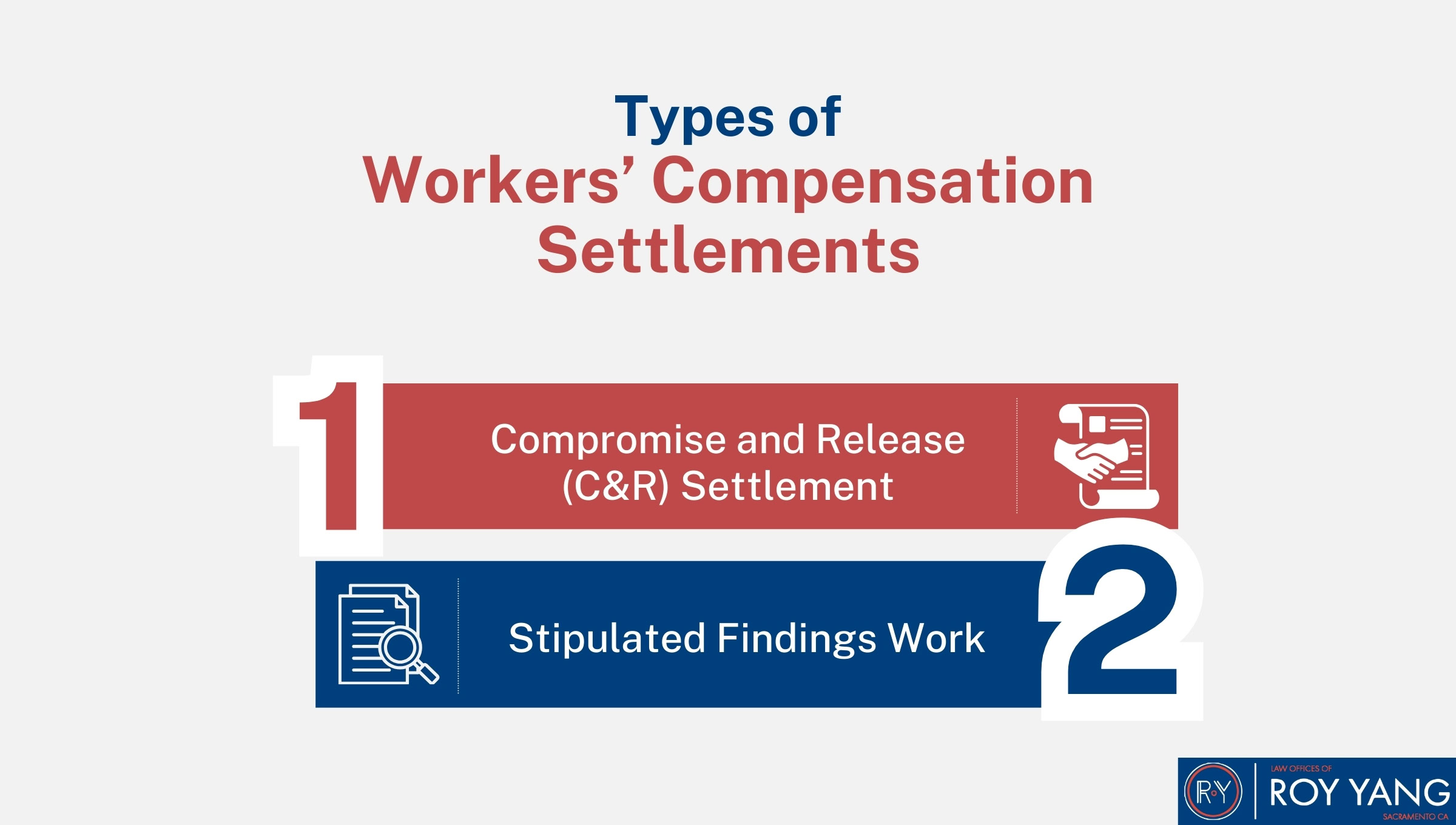

Types of Workers’ Compensation Settlements

Workers’ compensation settlements typically fall into two main categories, each with its own legal structure and impact on your benefits.

Compromise and Release (C&R) Settlement

A Compromise and Release (C&R) is one of the most common types of workers’ comp settlements. With this agreement, you receive a one-time lump sum payment to fully and finally resolve your claim. In exchange, the insurance company is released from any future liability related to that injury.

This option is ideal if you need ongoing treatment or want to keep your medical benefits open while securing the compensation that you are entitled to receive.

Stipulated Findings Work

A Stipulated Findings and Award is another type of workers’ compensation settlement. In this arrangement, you and the insurance company agree on specific facts about your injury, such as your level of permanent disability and your right to receive future medical care.

Unlike a Compromise and Release, this settlement does not close your case completely. It allows you to continue receiving medical care related to your injury while resolving the financial aspects of your claim.

This option is ideal if you need ongoing treatment or want to keep your medical benefits open while securing the compensation you’re entitled to.

Key Things to Know Before Finalizing Your Workers’ Comp Settlement

Workers’ compensation settlements are not just about the amount you win— you also have options for how your benefits are delivered. Whether you’re considering mixed payment formats, looking into informal resolutions, or wondering about tax implications, understanding the structure behind your settlement is key to making confident, informed decisions.

Can You Use Mixed Payment Formats?

Yes, some workers’ compensation settlements can be structured using mixed payment formats, often referred to as a hybrid settlement. This approach combines a lump sum payment upfront to help with immediate expenses like medical bills or debt with structured payments that provide steady, ongoing financial support over time.

This option offers the best of both worlds: flexibility when you need it most, and steady income to help with future planning. If you’re unsure whether this format suits your situation, we can help evaluate the pros and cons based on your medical needs and financial goals.

Are Informal Workers’ Comp Settlement Legal?

Yes, informal workers’ comp settlements can be both legal and binding, as long as they comply with state workers’ compensation laws. These agreements directly between you and the insurance company are often reached early in the process, and they may cover specific medical bills, lost wages, or other limited benefits.

While informal settlements can avoid lengthy court proceedings, they still require careful review. It is absolutely critical to read every word including the fine print, to ensure that your long-term rights and benefits are protected. We’ll advise you if an informal resolution is a smart, fair option in your case, or if a more formal route is in your best interest.

Are Workers Compensation Settlements Taxable?

In most cases, workers’ compensation benefits for physical injuries are not taxable under IRS Code Section 104(a). This means the money you receive for medical expenses or lost wages due to a work-related injury is typically tax-free at the federal level.

However, certain parts of a settlement may be taxed, such as compensation for emotional distress unrelated to physical injury or any punitive damages. To avoid surprises and protect your benefits, it is smart to consult both a workers’ comp attorney and a tax advisor when reviewing your settlement terms.

Choosing the Right Settlement Format

Deciding between a lump sum or structured settlement in your workers’ compensation case is a deeply personal choice. It requires you to consider more than just the money. You’ll need to think about your health, your financial responsibilities, your future, and your family. Your recovery outlook, financial needs, and life circumstances all play a critical role in making the decision that truly supports your long-term well-being.

Injury Severity and Recovery Outlook

The seriousness of your injury, and how long recovery may take directly impact which settlement format makes the most sense.

- If you’re facing ongoing medical care or a long-term disability, structured payments can offer dependable, continued support.

- If your injury is less severe and your recovery is expected to be shorter, a lump sum may provide the immediate resources you need to move forward.

Age, Career Stage, and Retirement

Where you are in your career and how close you are to retirement can drastically shape your priorities and decisions.

- Younger workers may benefit from lump sums to invest in new opportunities or career shifts.

- Those closer to retirement may find structured payments provide peace of mind and help stretch benefits over the years ahead.

Planning with your future goals in mind is essential to making the right choice for this stage of your life.

Financial Obligations and Debt

Your current money responsibilities, like debts or regular bills, are important to consider. If you have large, pressing debts, a lump sum payment could help address these right away. If your existing obligations are manageable, structured payments might offer a comfortable way to receive your workers’ compensation benefits over time without the pressure of managing a large single amount.

Your current financial situation is a big part of the equation.

- If you’re managing high-interest debt, major expenses, or financial strain, a lump sum can offer immediate relief and flexibility.

- On the other hand, if your expenses are steady and manageable, structured payments can provide consistent, stress-free income to support your day-to-day needs.

We’ll help you weigh your priorities so that your workers’ compensation benefits adequately support your financial stability, not just today but in the long term.

Lump Sum Management Ability

A lump sum offers flexibility, but with that comes greater fiscal responsibility. Managing a large payout requires strong budgeting habits and, in many cases, professional financial advice. Being honest with yourself about your ability to handle and preserve a large sum is key to making it last.

Dependents and Estate Planning

If you have family members who rely on you financially, their needs must be part of your decision.

- Structured settlements can provide ongoing support for your household.

- Lump sums, when managed well, can offer more control over how and when funds are used, including how they fit into your estate plan.

We’re here to help you structure your settlement in a way that supports both your future and the well-being of those who depend on you.

Settlement Negotiation and Legal Support

Reaching a fair workers’ compensation settlement often involves careful timing and knowledgeable support. Understanding when to negotiate and who can help you is very important for your compensation claim.

If your situation seems unclear, do not venture a guess—arrange to speak with a qualified workers’ compensation attorney ASAP to get answers.

When and How Negotiations Happen

Negotiations for your workers’ comp settlement can happen at different points in your claim. Here are common timings:

- After Reaching Maximum Medical Improvement (MMI): Once your doctor says your condition is stable, your long-term medical outlook is clearer, making it easier to value your claim.

- Following an Impairment Rating: If your work-related injury results in permanent impairment, negotiations often start after this rating is given.

- Before a Formal Hearing: Many compensation claims are settled before a formal hearing to avoid the uncertainty and costs of litigation.

- During Mediation: A knowledgeable neutral party, also known as a mediator, can help you and the insurance company discuss and reach an agreement.

- Any Time After Claim Filing: For some simpler compensation claims, early discussions can sometimes lead to a quick resolution.

Do You Need a Workers’ Comp Attorney?

Having a workers’ comp attorney greatly benefits your settlement process for a California workplace injury. An experienced attorney understands complex compensation laws and knows how to build strong evidence for your case. They work to protect your rights when dealing with the insurance company. The legal team handles the negotiations, aiming for the best possible workers’ compensation benefits for you.

Role of Financial Advisors

For settlements that involve structured payments or a large lump sum, a financial advisor offers valuable guidance. This is especially true if your workplace injury has lifelong effects. They can help design a payment schedule that meets your long-term money needs. Financial advisors also explain tax considerations and assist with planning for your overall financial well-being, allowing your settlement to provide lasting support.

Help Choosing a Workers’ Comp Settlement Type

Making the right choice about your workers’ comp settlement structure can feel like a big task. You do not have to handle this complex process alone. If you have questions about your work-related injury, compensation benefits, or how to approach your compensation claim with the insurance company, we are here to provide experienced representation.

Ready to discuss your workers’ comp settlement? Contact us now for your free, no-obligation consultation. Get the answers and support you deserve.