In California, workers’ compensation for small businesses is a legal requirement that protects employees from job-related injuries and provides financial security for business owners.

Under California Labor Code §3700, any business with one or more employees must carry this coverage, regardless of size, industry, or structure.

When a workplace injury occurs, workers’ comp for small businesses covers medical treatment and wage replacement while limiting the employer’s liability under California’s exclusive remedy rule. Understanding workers’ compensation insurance in California is essential for small business owners to ensure compliance, reduce financial risks, and secure the long-term health of their business. With the best workers’ comp insurance for small businesses, business owners can be well-covered without overpaying.

Beyond coverage, workers’ compensation for small businesses involves understanding claims, exemptions, and legal processes. Consulting with a professional workers’ comp lawyer can help ensure compliance and protection.

Key Takeaways

- Workers’ compensation insurance covers the cost of workplace injuries and illnesses, helping small businesses protect employees and prevent financial loss.

- Workers’ comp (or workman’s comp) provides employees with medical treatment and wage replacement after work-related accidents or occupational illnesses.

- California requires all businesses, including small companies, to carry workers’ comp insurance, even if they employ only one worker.

- Small business workers’ compensation coverage keeps employers compliant, reduces liability, and supports injured employees during recovery.

- Workers’ comp can help protect business owners from lawsuits, penalties, and uninsured injury claims that could threaten their operations.

- Legal guidance is essential – an experienced workers’ comp lawyer at The Law Office of Roy Yang helps small business owners meet compliance standards, avoid penalties, and safeguard their workforce.

What Workers' Compensation Means for Small Businesses in California?

Workers’ compensation plays a different role in a small business than it does in a large corporation. Smaller teams often face tighter budgets, fewer internal resources, and more personal exposure when something goes wrong.

Why Workers' Compensation Matters for California Employers?

For California employers, including family-run businesses and sole proprietorships with staff, workers’ comp significantly reduces both financial and legal risks. Here’s why:

- Insurance costs less than a lawsuit: Paying monthly premiums is almost always less expensive than covering hospital bills, lost wages, or attorney fees after an injury.

- It limits legal liability: Under California’s exclusive remedy rule, once an employee accepts workers’ comp benefits, they generally waive the right to sue the employer for damages.

- Non-compliance is expensive: According to Labor Code §3700.5, failing to secure coverage can result in fines, stop-work orders, criminal charges, or lawsuits, all of which can put a small business at risk of closure.

Common Scenarios Where Small Businesses Use Workers' Compensation

Even in low-risk industries, injuries can occur when least expected. Workers’ compensation claims often go beyond obvious accidents and may involve long-term conditions, job-related travel, or mental health injuries.

Here are examples of workplace incidents where small business workers’ comp coverage applies:

- Physical Injuries: A barista at a local cafe slips on a wet floor and fractures a wrist. The injury leads to medical treatment and time off, triggering the cafe’s workers’ compensation policy.

- Occupational Illnesses: A janitor exposed to cleaning chemicals develops respiratory issues like chronic bronchitis. The business’s coverage helps pay for treatment and recovery time.

- Work Vehicle Accidents: A delivery driver for a small bakery is injured in a car accident while transporting products. Because the employee was “on duty,” the claim qualifies for workers’ compensation.

These incidents are classified as work-related under California law. In each case, workers’ compensation benefitstypically cover the employee’s medical costs and partial wage replacement, while also protecting the employer from direct legal action.

Key Rules & Requirements for Workers' Comp in California Small Businesses

Complying with California’s workers’ compensation laws requires more than just carrying a policy- it means understanding who must be covered, when coverage applies, and what happens if you fall short.

When Workers’ Comp Coverage Is Required for Small Businesses?

Workers’ compensation becomes mandatory as soon as a business hires its first employee, even if the role is part-time, seasonal, or temporary.

This requirement also applies to family members or relatives working in the business. Coverage must be active from the employee’s first day on the job.

Who Must Be Covered Under Workers’ Comp (Employee Classification Rules)

Workers’ compensation covers anyone classified as a workers’ compensation employee under California law. Covered workers include:

- Full-time or permanent staff

- Temporary, part-time, or seasonal employees

- Family members helping in the business

Independent contractors are not covered unless they are misclassified. To determine worker status, California applies the ABC test under Assembly Bill 5 (AB5).

If a worker fails the ABC test, they are considered an employee and must be covered under a workers’ comp policy.

Penalties for Not Having Workers’ Compensation Coverage

Operating a business without workers’ compensation insurance is a misdemeanor under California Labor Code §3700.5.

Penalties for non-compliance include:

- Civil penalties of up to $100,000

- Regulatory action, such as stop-work orders and criminal charges

- Potential civil lawsuits from injured employees and personal liability for all related costs.

These are not just theoretical risks. In our legal practice, we’ve seen small businesses shut down after a single uncovered injury.

How Workers' Compensation Obligations Differ for Small Employers?

While the legal requirements are the same for all employers, small businesses face unique compliance challenges, including:

- Limited Administrative Rresources: Smaller teams may not have dedicated HR to handle claims or audits.

- Higher Cost Sensitivity: A premium increase after one claim can put pressure on already narrow margins.

- Fewer Legal Buffers: Without legal guidance, responding to audits or disputes is more difficult, raising exposure.

What the California Labor Code Says About Workers' Compensation

The California Labor Code lays out the fundamental requirements for the state’s workers’ compensation laws.

| Key provisions for employers | Key provisions for employees |

|---|---|

| Mandatory coverage (Section 3700) | Right to medical treatment (Section 4600) |

| Penalties for non-compliance (Section 3700.5) | Protection for all employees (Section 3351) |

| Exclusive remedy (Section 3602) | Timely treatment (Section 5402) |

These statutes make one thing clear: every business in California with at least one employee must carry workers’ compensation insurance. There are no exemptions for startups, home-based businesses, or family-run operations.

What Workers’ Compensation Covers for Small Businesses?

Workers’ compensation coverage offers two core protections: financial support for injured employees and legal protection for employers. The benefits available depend on the nature of the injury and the employee’s status, but most cases involve coverage in the following key areas:

Medical Care and Wage Replacement Benefits

Workers’ compensation covers medical bills and lost wages after a job-related injury. Here’s what that typically includes:

- Immediate Medical Costs: Covers doctor visits, emergency care, hospital stays, prescriptions, and necessary medical devices.

- Temporary Disability Payments: Provides partial wage replacement while the employee is unable to work due to injury.

- Rehabilitation Services: Includes physical therapy or vocational retraining to help the employee return to their role or transition to a new one.

Permanent Disability and Death Benefits

For more serious cases, when an injury results in long-term disability or death, workers’ compensation provides extended support to employees or their dependents:

- Permanent Disability: If the employee cannot fully recover, workers’ comp offers ongoing payments. Benefits are calculated based on the worker’s impairment rating, wages, and type of job.

- Death Benefits: In fatal cases, dependents may receive income replacement or survivor benefits based on the worker’s average weekly wage, along with funeral expenses, as defined by state regulations.

Employer Liability Protection Under Workers’ Comp

Under the exclusive remedy rule, workers’ compensation generally prevents employees from suing their employer for a work-related injury or illness as long as coverage is in place.

For small business owners, this protection helps avoid costly litigation, reduce overlapping claims, and maintain financial stability after an incident.

How the Workers’ Compensation Claim Process Works in California?

The claim process in California is structured around strict timelines and documentation. Employers and employees both have specific legal responsibilities, and missing a step can lead to delays, penalties, or claim denial.

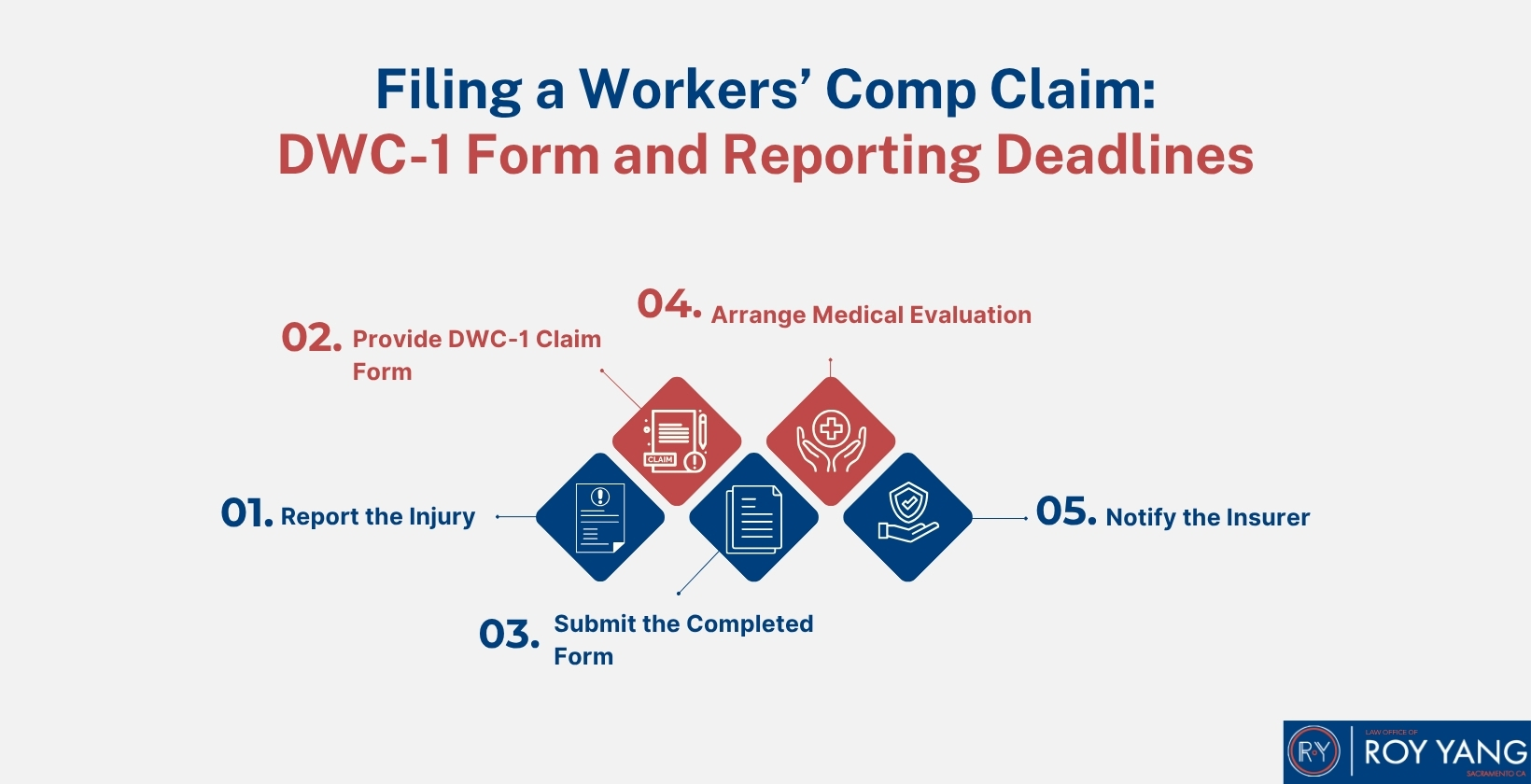

Filing a Workers’ Comp Claim: DWC-1 Form and Reporting Deadlines

When an employee reports a work-related injury or illness, employers in California must immediately initiate the workers’ compensation claim process. The standard steps for filing a claim are:

- Report the Injury: The employee should notify the employer as soon as possible.

- Provide DWC-1 Claim Form: Within one working day of learning about the injury, the employer must give the injured worker a DWC-1 Workers’ Compensation Claim Form.

- Submit the Completed Form: The employer sends the completed DWC-1 to their insurance carrier, ideally within 24 hours and no later than 30 days.

- Arrange Medical Evaluation: Ensure the injured employee receives prompt medical treatment.

- Notify the Insurer: The insurance company will then review the claim and begin the claims-handling process.

What Employers Must Do During the Workers’ Comp Claim Process?

After the claim is submitted, employers still have active legal duties. Small business owners must:

- Investigate the Incident: Document when, where, and how the injury happened.

- Cooperate with the Insurer: Provide all requested records, statements, and documentation.

- Offer Modified Duties: If possible, allow the employee to return to work under medical restrictions.

- Maintain Communication: Keep the injured worker informed and engaged throughout the process.

- Avoid Retaliation: Never discipline or terminate an employee for filing a claim; this is illegal in California.

Claim Review and Benefit Distribution Timeline

After the insurance company receives the completed claim form, these timelines apply:

| Duration | Description |

|---|---|

| 14 days | The insurer must either accept, deny, or notify that the claim is under investigation. |

| 90 days | If no denial is issued within this period, the claim is presumed accepted by law. |

| Payments | Once accepted, temporary disability and medical benefits must begin promptly. |

Workers’ Compensation Costs for Small Businesses

As of September 2025, the California Insurance Commissioner set the advisory base rate at $1.52 per $100 of payroll.

The cost of workers’ compensation for small businesses depends on several factors, including industry type, claims history, and total payroll.

Key Factors That Affect Workers’ Comp Premiums

Insurers determine workers’ compensation premiums in California using several measurable factors, such as:

- Industry & Risk Classification: The Workers’ Compensation Insurance Rating Bureau (WCIRB) assigns classification codes based on industry type and risk level. High-risk jobs (like construction or food delivery) cost more to insure than office-based roles.

- Total Payroll: Premiums are calculated as a percentage of payroll. Higher payroll means higher premium costs.

- Experience Modification Rate (EMR): This reflects your claims history. A clean record lowers your EMR; frequent or severe claims drive it up.

- Workplace Safety Record: Businesses with documented safety programs and few reported injuries often receive lower rates.

These variables help insurers assess how likely your business is to file a claim and how much it might cost.

Practical Tips to Keep Workers’ Comp Premiums Affordable

Small businesses can reduce workers’ comp costs by improving workplace safety and tightening their reporting and administrative processes. Here are five practical ways to lower premiums without sacrificing coverage:

- Train for Safety: Conduct regular safety training tailored to your workplace risks.

- Report Injuries Immediately: Prompt reporting avoids claim delays, penalties, and premium increases.

- Review Classifications Annually: Confirm that employee roles and payroll data are accurate before each renewal.

- Keep Precise Records: Maintain clear payroll, job descriptions, and incident logs to prevent billing errors or audit issues.

- Improve Ergonomics: Make small changes like adjusting equipment or workflow to prevent long-term injuries.

Consistent safety practices don’t just protect your team; they help build a claims history that keeps your insurance rates under control.

Challenges Small Businesses Face With Workers’ Compensation

For small employers, complying with California workers’ compensation laws often feels like navigating a system built for larger companies. Limited budgets, minimal staffing, and complex legal standards make it hard to stay compliant while managing day-to-day operations.

Here are three common challenges that small business owners must prepare for to avoid penalties and coverage issues:

Managing Workers’ Comp Costs on a Limited Budget

Tight margins make workers’ comp premiums particularly stressful for small business owners. Even a single claim can trigger a premium hike that strains the budget.

For example, a small cafe hit with an 8% increase after one minor injury might need to reduce staffing hours just to stay afloat.

Careful budgeting and risk management are essential to keep coverage active and affordable.

Handling Disputes and Denied Claims Without Legal Support

Denied claims often require more than just paperwork; they can involve medical evidence, insurer communications, and formal appeals through the Workers’ Compensation Appeals Board (WCAB).

Without legal guidance, small business owners may miss deadlines, misfile documents, or unintentionally waive their rights.

Balancing Compliance With Daily Business Operations

Small business owners juggle multiple roles. Tasks like payroll reporting, WCIRB audits, and safety documentation often compete with customer service, inventory, or scheduling.

Without dedicated HR or legal teams, maintaining full compliance becomes a daily balancing act, and small oversights can lead to serious consequences.

How a Workers’ Compensation Lawyer Can Support Your Small Business

Handling workers’ comp claims, audits, or disputes without legal guidance often leads to avoidable mistakes and costly consequences.

An experienced workers’ compensation lawyer helps small business owners stay compliant, reduce liability, and protect long-term stability.

Setting Up Compliant Workers’ Comp Coverage From the Start

A workers’ comp attorney can review your policy to ensure coverage meets California requirements and aligns with your business structure.

They also help small employers set up internal procedures for claims, documentation, and employee classification, including the correct use of WCIRB codes.

Getting it right from the beginning prevents disputes, underpayments, and audit-related penalties later on.

Legal Representation in Workers’ Comp Disputes or Audits

If a claim is delayed, denied, or flagged during an audit, legal representation becomes critical.

A defense attorney handles communication with the insurance carrier, organizes medical and employment records, and represents your business in WCAB hearings or other legal proceedings.

Reducing Legal and Financial Risks for Your Business

Ongoing legal oversight helps spot compliance gaps before they lead to claims, penalties, or rising premiums.

Regular policy reviews, classification audits, and documentation checks reduce long-term exposure and make future renewals more predictable.

With legal support in place, business owners can focus on daily operations instead of reacting to regulatory problems.

How to Choose the Right Workers’ Compensation Policy in California?

Small businesses in California can buy workers’ compensation insurance from the State Compensation Insurance Fund (State Fund) or through licensed private insurers. The best policy isn’t always the cheapest, it’s the one that fits your specific needs, including workforce size, risk exposure, and claims history.

Compare coverage limits, claims-handling practices, and the insurer’s reputation not just the price. Missteps like underinsuring high-risk roles or misclassifying workers can lead to penalties, audits, or denied claims.

Before choosing a policy, it’s wise to speak with a workers’ compensation attorney or a qualified insurance advisor familiar with California law. A quick consultation can prevent costly mistakes later.

Does a Small Business Need Workers’ Compensation Insurance in California?

Yes. If your business has even one employee even part-time or seasonal. California law requires you to carry workers’ compensation insurance.

Only sole proprietors and business partners without employees are exempt. Everyone else must comply, including family-run businesses and startups.

FAQs About Workers’ Compensation for Small Businesses

How soon after hiring must a small business provide workers’ comp coverage?

To provide workers’ comp coverage, a small business must have it active on the first day of employment. California Labor Code §3700 requires coverage with no waiting period, even for part-time or temporary workers.

Are family members working in a small business covered by workers’ compensation?

Yes. Family members working in a small business are treated as employees under California law and must be covered by workers’ compensation, regardless of their relationship to the owner.

Can small businesses purchase workers’ compensation insurance online in California?

Yes. Small businesses in California can purchase workers’ compensation insurance online from licensed insurers or the State Fund, and should verify the insurer’s license through the California Department of Insurance (CDI).

Does remote work create workers’ comp liability in California?

Yes. Remote work creates workers’ comp liability if an injury occurs during the course of employment. California requires coverage for remote, part-time, or full-time workers under the same rules as on-site staff.

Can a small business be fined for late workers’ comp payments?

Yes. A small business can face fines, stop-work orders, and liability for uncovered injuries due to late or missed premium payments, as outlined in California Labor Code §3700.5.

What documentation is required during a workers’ comp audit in California?

Required workers’ comp audit documentation includes payroll records, tax filings, job classifications, insurance certificates, and logs of claims, injuries, and safety training. Audits verify compliance and premium accuracy.

What should small businesses do if an employee refuses workers’ compensation benefits?

If an employee refuses benefits, small businesses must document the refusal, notify the insurance carrier, and avoid any retaliation. The insurer will record the decision and explain legal consequences to the employee.

What types of injuries are commonly denied by workers’ comp insurers?

Workers’ comp insurers often deny claims involving late reporting, pre-existing conditions, lack of medical proof, mental health, or injuries without witnesses or with unclear connection to work duties.

Avoiding Workers’ Comp Penalties: What California Small Businesses Must Do

coverage as soon as you hire your first employee.

Small businesses must stay compliant by paying premiums on time, keeping accurate payroll records, and classifying employees correctly under AB5.

In case of disputes or audits, contact a trusted workers’ compensation lawyer

to avoid fines, policy cancellations, or legal action.