Temporary Total Disability (TTD) is a workers’ compensation benefit paid to employees who are completely unable to work for a limited time due to a job-related injury or illness. In California’s no-fault system, TTD helps replace lost wages while the worker recovers and is expected to return to work.

Understanding what TTD is lays the foundation, but it’s just the start. To protect your benefits, you need to know how the system works, how long payments last, who qualifies, and what can cause your checks to stop.

Key Takeaways

- TTD offers temporary wage replacement (typically 2/3 of Average Weekly Wage, non-taxable) in California’s no-fault system for doctor-certified total inability to work due to a job injury.

- To receive TTD, promptly report your injury, submit a DWC-1 form to your employer (who forwards it to the insurer), and secure ongoing medical proof of your work incapacity.

- TTD benefits generally last up to 104 weeks (extendable for severe injuries) but end sooner if you’re medically cleared for work, reach Maximum Medical Improvement (MMI), or violate claim rules.

- You cannot work (unless medically approved light-duty) or collect unemployment while on TTD; doing so can terminate benefits and lead to penalties.

- If impairment persists after TTD, you may transition to Permanent Disability; claim denials are common, and understanding your Average Weekly Wage (AWW) is key for correct payment.

- While you can’t be fired for filing a claim, other termination reasons are valid; an attorney is vital for protecting rights, navigating denials, maximizing benefits, and managing complex claim issues.

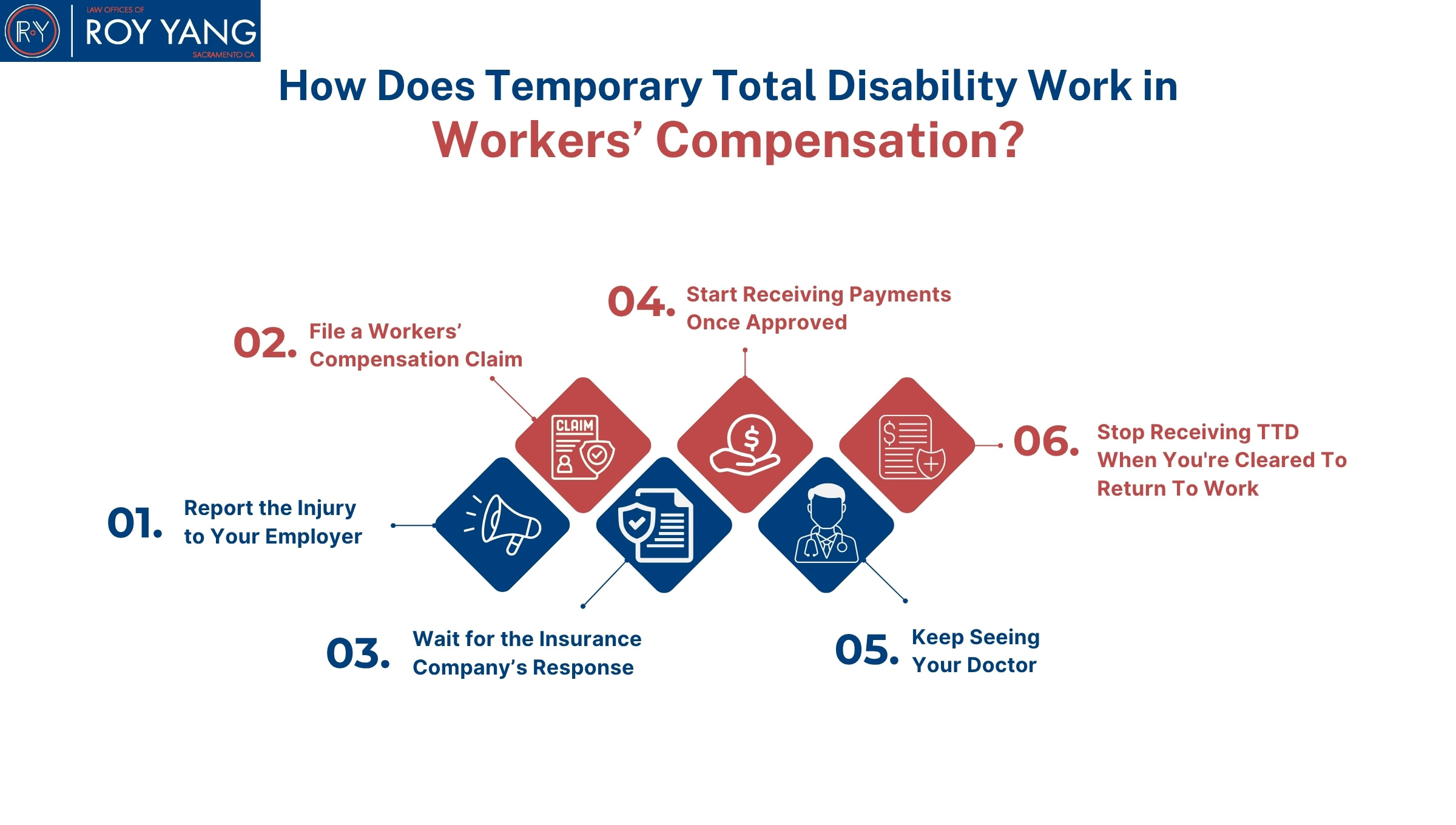

How Does Temporary Total Disability Work in Workers’ Compensation?

Temporary Total Disability (TTD) begins after a doctor confirms that your injury fully prevents you from working, and your workers’ compensation claim is approved.

To receive TTD benefits:

- Report the Injury to Your Employer: Inform your employer right away. Reporting late can delay your claim.

- File a Workers’ Compensation Claim: Submit details about the injury and a doctor’s statement confirming you cannot work.

- Wait for the Insurance Company’s Response: The insurer has 14 days to approve or deny the claim after receiving your documents.

- Start Receiving Payments Once Approved: TTD payments usually equal two-thirds of your average weekly wage, paid every two weeks.

- Keep Seeing Your Doctor: Your doctor must send regular updates showing you still can’t work. These updates keep your benefits going.

- Stop Receiving TTD When You’re Cleared To Return To Work: Benefits end when the doctor says you can work again or do light-duty tasks.

TTD follows strict steps and medical checks. The insurance company sends payments, but your doctor controls how long they continue.

Before benefits can begin, you must meet the right conditions to qualify.

Who Qualifies for Temporary Total Disability Benefits?

You may qualify for Temporary Total Disability (TTD) benefits if you’ve been injured on the job, your doctor confirms that you’re unable to work temporarily, and your workers’ compensation claim has been accepted.

To qualify for TTD benefits in California:

- A doctor must certify that you are completely unable to perform your job.

- The injury must be directly caused by your work or the work environment.

- The injury must be reported to your employer in a timely manner.

- You must file a formal workers’ compensation claim.

The insurance company must accept the claim and approve liability. - In California, part-time and undocumented workers may still qualify.

TTD eligibility depends entirely on medical proof and claim approval. Without both, benefits do not begin. If you meet all of these conditions, you’re considered eligible for TTD benefits under California workers’ compensation law, which is part of the protections outlined in Workers Comp Cover.

While TTD focuses on temporary wage replacement for the injured worker, families should know that if the injury is fatal, death benefits from workers’ comp can provide critical financial support for dependents

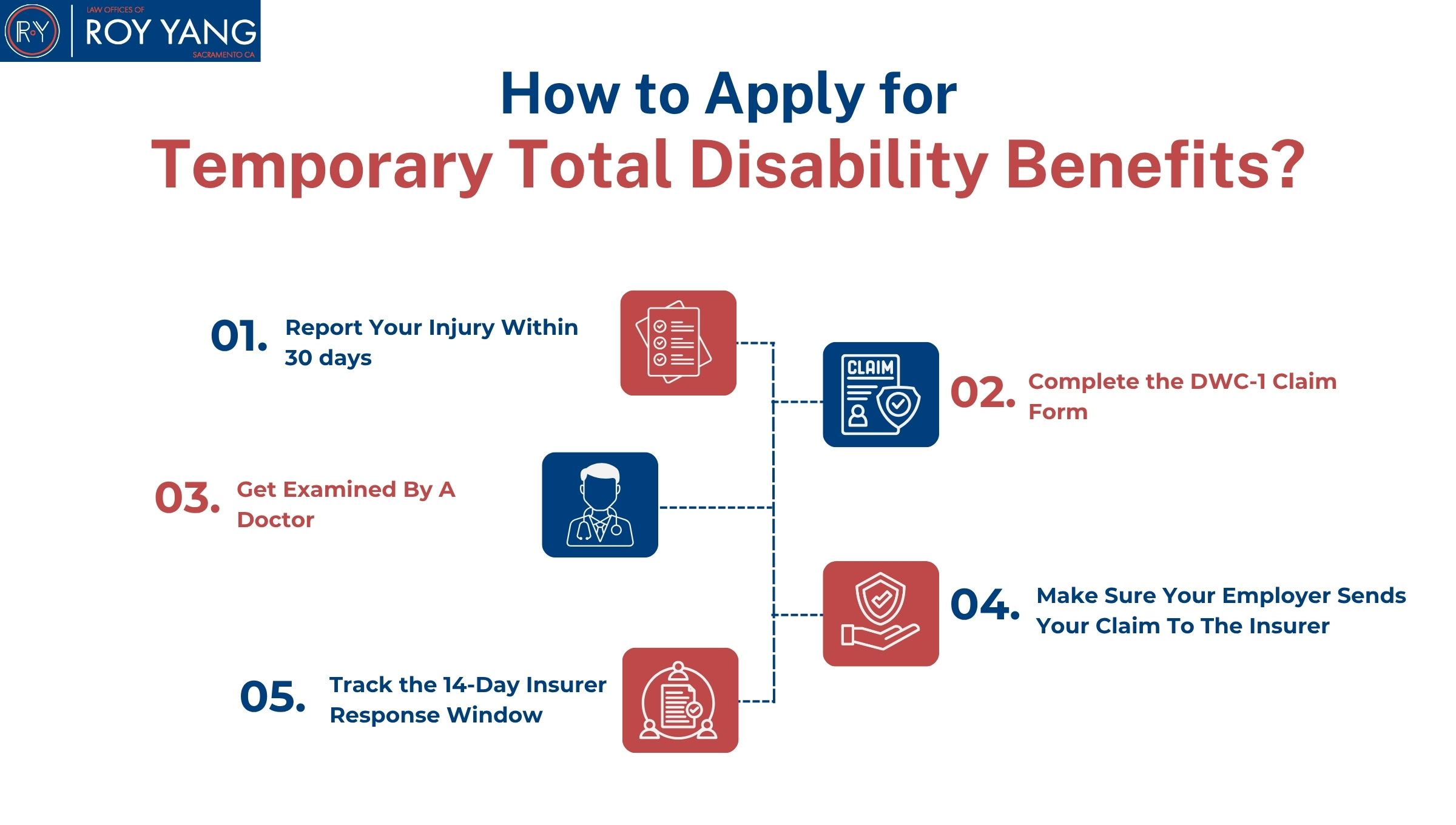

How to Apply for Temporary Total Disability Benefits?

To apply for Temporary Total Disability (TTD) benefits in California, you must complete five steps. Each step must be done on time to keep your claim valid.

- Report Your Injury Within 30 days: Notify your employer as soon as the injury happens. Waiting too long can risk your right to benefits.

- Complete the DWC-1 Claim Form: Your employer must give you this form within one working day of your report. Fill out your section and return it promptly.

- Get Examined By A Doctor: The doctor must confirm in writing that your injury stops you from doing your job.

- Make Sure Your Employer Sends Your Claim To The Insurer: Your employer is responsible for submitting the form and medical evidence to the insurance company.

- Track the 14-Day Insurer Response Window: The insurer must accept, deny, or delay your claim within 14 days of receiving all documents.

TTD benefits start only after both the form and doctor’s certification are submitted. Save all paperwork and follow up if responses are delayed.

Once your claim is approved, the next question is how long those benefits will last.

How Long Do Temporary Total Disability Benefits Last?

Temporary Total Disability (TTD) benefits last up to 104 weeks within five years from the date of injury, according to California Labor Code Section 4656. These weeks do not have to be used consecutively.

Some workers may qualify for up to 240 weeks of TTD if they suffer from:

- Severe burns

- Chronic lung disease

- High-level amputations

- Serious brain injuries

A doctor must confirm these injuries in writing, supported by medical evidence. Once the 104-week cap is reached, benefits stop unless your condition meets the exception requirements under the same code. But sometimes, benefits stop before that limit, often for reasons tied to your medical status or cooperation.

What Can Cause TTD Payments to End Early?

Temporary Total Disability (TTD) benefits don’t always last the full 104 weeks. Some changes in your recovery or claim can cause payments to stop early. Here are the most common reasons:

- You’ve healed as much as possible: Your doctor confirms no further treatment will improve your condition.

Example: After physical therapy, your doctor says your recovery is complete. - You’re cleared to return to work: You may be released for full duty or light-duty tasks.

Example: You’re cleared to handle desk work after a leg injury. - You miss scheduled doctor visits: Skipping care without a reason can pause or stop your benefits. Example: You miss two follow-ups and do not reschedule.

- You turn down a job you’re able to do: If you’re approved for light-duty work and refuse, benefits can end.

Example: Your employer offers a seated role, but you decline it. - You’re dishonest about your condition: Fraud, like hiding work activity or exaggerating injuries, stops payments immediately.

Example: You’re seen moving heavy items while claiming you can not walk.

If something feels wrong, we help you understand why your benefits may have ended, review your case and guide you forward.

How Are Temporary Total Disability Payments Calculated?

Temporary Total Disability (TTD) payments are calculated as two-thirds of your average weekly wage, subject to California’s minimum and maximum payment limits. These benefits are designed to partially replace your lost income while you’re recovering from a work-related injury.

Under California law, Temporary Total Disability (TTD) benefits are subject to annual minimum and maximum limits. If your calculated weekly benefit exceeds the state maximum, you’ll receive the maximum allowed. If it falls below the minimum threshold, you’ll receive the minimum benefit set by law.

Example:

If you earned $1,200 per week before your injury:

$1,200 × 2/3 = $800 per week

If you earned $300 per week:

$300 × 2/3 = $200 per week, or the state minimum, whichever is higher.

These amounts all depend on how your average weekly wage (AWW) is calculated. That’s the first step in figuring out your benefit.

Average Weekly Wage and Benefit Percentages

Your Average Weekly Wage (AWW) is the average of what you earned before your injury, including regular pay, overtime, bonuses, and part-time wages. This number forms the basis for your TTD calculation.

In California, AWW is typically figured using your earnings from the 52 weeks before your injury, divided by the number of weeks you actually worked.

Example:

You earned $52,000 over 52 weeks:

$52,000 ÷ 52 = $1,000 AWW

$1,000 × 2/3 = $666.67 per week

Holiday pay, shift bonuses, commissions, and tips all count if they were part of your regular income. A full wage history gives you the most accurate result.

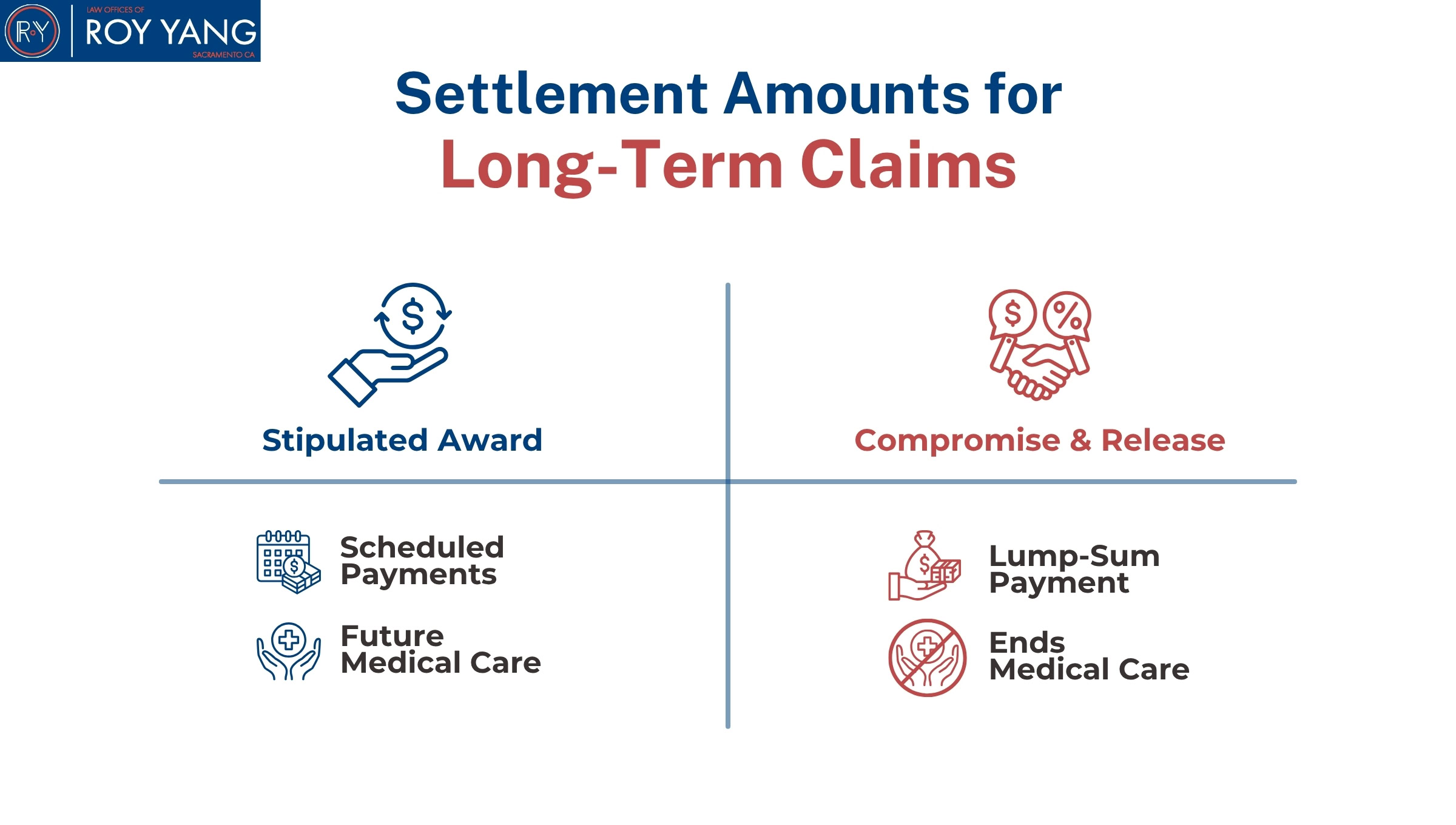

Settlement Amounts for Long-Term Claims

If your injury leads to long-term problems, your claim may be settled instead of continuing with weekly TTD payments. In California, you usually settle in one of two ways:

- Stipulated Award: You receive scheduled payments and keep your right to future medical care.

- Compromise & Release: You get a lump-sum payment, but give up future medical care for this injury.

Settlement value depends on how long you’d continue receiving benefits and what future medical care you may need. We guide workers through these options to help them make informed decisions before signing anything.

Are Temporary Disability Payments Taxable?

No, Temporary Total Disability (TTD) payments are not taxable under federal or California law. These benefits are not treated as income by the IRS.

Rare Exception:

If your TTD benefits are combined with certain Social Security payments, a small part may be taxed, but that rarely applies.

In nearly every case, the benefits you receive are tax-free.

What Happens When TTD Ends?

When Temporary Total Disability (TTD) ends, some workers are cleared to return with no restrictions. Others still face long-term effects and need continued support.

Before making decisions, it’s important to speak with your doctor and a workers’ compensation attorney. We understand this phase can be uncertain, but you don’t have to handle it alone.

At this point, what comes next depends on how much you’ve recovered, how your doctor evaluates your condition, and whether you’re cleared to work or facing long-term limits.

Can You Move to Permanent Disability After TTD?

Yes. If your recovery has stopped progressing and your doctor says no further improvement is expected, you may move from TTD to permanent disability.

This is known as Maximum Medical Improvement (MMI). Once you reach MMI, your doctor will assess whether you qualify for:

- Permanent Partial Disability (PPD): You can work, but not at full capacity.

- Permanent Total Disability (PTD): You cannot return to any kind of work.

This decision is based on your impairment rating, which measures how much function you’ve lost due to your injury. We help you understand that rating and make sure it’s applied fairly to your case.

When Does TTD End, and Why?

TTD end when certain medical or legal conditions are met. Here’s when and why they typically stop:

- You’re medically cleared to return to work (either full duty or modified duty).

- You reach Maximum Medical Improvement (MMI), meaning your condition is stable and unlikely to improve with further treatment.

- You miss medical appointments or fail to follow your treatment plan, which can impact your eligibility.

- You refuse suitable work that fits within your medical restrictions.

Exceptions:

Some serious or long-term injuries may qualify for extended TTD benefits up to 240 weeks, including cases involving:

- Severe burns

- Amputations

- Lung disease

- Major brain or eye injuries

Your doctor’s regular medical evaluations will guide how long your benefits continue. Staying engaged in treatment and following medical advice helps protect your eligibility for ongoing support.

Can You Work or Get Other Benefits While on TTD?

No, you can’t work full-time or collect unemployment while receiving TTD. TTD means your injury prevents you from doing any work.

Taking a job or applying for conflicting benefits could stop your payments, or worse, result in penalties for fraud.

In some cases:

- You may still qualify for other non-conflicting aid, like food assistance

- You may be approved for light-duty work, but only with written clearance from your doctor

If you’re unsure whether a benefit or job offer affects your claim, we’ll help you review it before you take a step that could put your benefits at risk.

Can I Work Part-Time and Still Get TTD?

You can only work part-time while on TTD if your doctor approves a light-duty job. Your employer must follow your restrictions, and your benefits may change to partial payments if your income is reduced. Even part-time or modified roles must be reviewed before you accept them.

In these cases:

- Your doctor writes specific work restrictions

- Your employer may offer a temporary light-duty position

- If your wages are lower, you may qualify for partial payments

We help make sure your employer and insurer follow the rules and your benefits stay protected. If your doctor hasn’t approved the work in writing, don’t start.

Common Reasons Why TTD Claims Are Denied

Temporary Total Disability (TTD) claims are often denied for specific reasons tied to timing, proof, or disputes. Here are the most common causes:

- Late Reporting: Delays in reporting your injury to your employer weaken your claim.

- Unrelated or Pre-existing Conditions: The insurer may claim your injury wasn’t caused by work.

- Lack of Strong Medical Documentation: If your doctor doesn’t clearly confirm you can’t work, benefits may be denied.

- Employer Disagreement: Your employer may dispute how or where the injury occurred.

- Signs of Possible Fraud: If you’re seen working or providing inconsistent information, the claim can be denied.

If your TTD claim is denied, it’s not the end of the road. You may still qualify for benefits through an appeal.

A workers’ compensation lawyer helps you respond quickly, gather the right medical evidence, and challenge the denial effectively. We know how to protect your rights and push back when insurers get it wrong.

Can You Get Fired While Receiving TTD?

Yes, an employer can terminate a worker while they are receiving Temporary Total Disability (TTD), but not because of the injury or workers’ compensation claim. In California, this type of retaliation is prohibited by law.

Legal protections include:

- Labor Code §132a: Prohibits discrimination or termination for filing a claim

- Anti-Retaliation Statutes: Prevent employers from punishing workers injured on the job

- Leave Laws: May apply based on company size and employment duration

Employers are still allowed to terminate workers for valid, unrelated reasons such as layoffs, policy violations, or business restructuring. If a termination occurs during a workers’ comp claim, the timing alone does not prove retaliation.

Can You Collect Unemployment While on TTD?

No, a worker cannot collect unemployment while receiving Temporary Total Disability (TTD). These programs serve different purposes and have conflicting eligibility requirements.

Key Difference:

- TTD is for employees who are medically unable to work due to a job-related injury

- Unemployment insurance requires the person to be physically able and available for work

Filing for both at the same time may lead to denial of benefits or legal consequences for conflicting claims. Unemployment may become available only after TTD ends and the worker is medically cleared to return to work, but the worker remains jobless.

How to File a Workers’ Comp Claim in California?

To initiate a workers’ compensation claim in California:

- Report the Injury Promptly: Notify your employer about the injury as soon as possible. Delays can affect your eligibility for benefits.

- Complete the DWC-1 Claim Form: Your employer is required to provide you with this form within one working day of learning about your injury. Fill out the “Employee” section, sign, and date it.

- Submit the Form to Your Employer: Return the completed form to your employer promptly. It’s advisable to keep a copy for your records.

- Employer’s Responsibility: Upon receiving your completed form, your employer should fill out the “Employer” section and forward it to their workers’ compensation insurance carrier.

- Insurer Notification: The insurance company has 14 days to send you a letter regarding the status of your claim. If you don’t receive this notification, contact the insurer directly.

- Medical Treatment Authorization: Within one day of receiving your claim form, your employer must authorize appropriate medical treatment, up to $10,000, while your claim is being reviewed.

How an Attorney Can Protect Your Rights and Maximize Benefits?

A workers’ compensation attorney advocates for your rights from the moment your injury is reported. Legal representation can be the difference between a denied claim and full compensation.

Attorneys help by:

- Filing your claim correctly and within legal deadlines

- Gathering documentation from medical providers, employers, and witnesses

- Filing appeals if your claim is delayed or denied

- Negotiating with insurance companies for the maximum benefits allowed under California law

Protecting you from retaliation or wrongful termination - Defending against fraud allegations when insurers question your activity or intent

- Recovering unpaid or underpaid benefits through the legal process.

Each of these actions ensures your claim is supported by solid evidence, a clear legal strategy, and accurate procedures. Hiring a workers’ comp lawyer is essential for securing TTD and other workers’ compensation benefits.

Legal Support from the Offices of Roy Yang

The Law Offices of Roy Yang has helped injured workers across California secure full Temporary Total Disability benefits even after denials or employer disputes. Roy Yang works with California-specific legal standards to protect claims from delays, disputes, and underpayments.

We build case strategies based on your injury, job classification, and wage history, focused on results, not shortcuts. With deep knowledge of California workers’ comp law, the firm anticipates how insurers operate and responds with strong legal pressure.

Constructing the path of justice is our moral. Every case is pursued with purpose, legal precision, and an understanding of what fair compensation truly means.

Whether the challenge is a denial, a delayed payment, or a wage miscalculation, we move cases forward through experience and strategy.

Deadlines can cost you benefits, Contact us today to secure your rights.