Yes, you can sometimes work while receiving workers’ compensation, but only under conditions that meet California’s medical and legal requirements. Many injured employees want to know whether light duty, modified work, or reduced hours can impact their benefits, and the answer depends on your treating physician’s approved restrictions.

Your doctor must confirm what tasks you can safely perform, and your employer must offer a role that matches those restrictions. When both align, you can return to limited work without jeopardizing your workers’ compensation payments. This system helps protect your recovery while still allowing you to earn.

“Can You Work While Receiving Workers’ Compensation?” is a common question, and the next sections outline exactly when working is allowed under California’s workers’ compensation rules.

Legal Conditions for Working While Receiving Workers’ Compensation

Working during a workers’ comp claim in California isn’t just about your ability. It depends on legal permission. The state sets narrow boundaries around what kind of work qualifies and under what conditions. These rules exist to prevent benefit misuse and protect injured workers from being pushed too far, too early.

Here’s how the law regulates employment while injured workers are on workers’ comp.

California Labor Code on Employment During Claims

According to California Labor Code 4658, employers have the option to offer modified or alternative work. However, injured workers can only accept such work if it aligns with the medical restrictions outlined by their Primary Treating Physician (PTP).

The law sets a strict limit: if your doctor says no heavy lifting, your job can’t involve lifting. If they limit your hours, your employer has to honor that. The state treats your doctor’s official report as the legal authority. In situations where no suitable work is available, you may continue receiving wage replacement benefits.

Restrictions on Earning Wages While on Disability Benefits

Workers’ compensation benefits replace lost income when a work injury prevents you from earning. But they do not allow stacking on top of new income. Suppose you’re collecting wage replacements, such as Temporary Total Disability (TTD) or Temporary Partial Disability (TPD). In that case, there are limits to what you can earn before those benefits are reduced or stopped.

There are certain restrictions:

- Doing side jobs without reporting them. You must disclose even small contractual works or cash gigs.

- Earning more than your partial disability allows.

- TPD benefits adjust based on what you’re earning now versus what you made before the injury.

- Taking work that breaks your medical restrictions. It can disqualify you from benefits entirely.

The extent of your work is not the controlling factor here. Rather, it is whether the work aligns with both your doctor’s restrictions and your benefit category.

Authorized Employment Types Under Comp Regulations

California permits certain types of jobs during recovery, as long as the job duties stay within your approved restrictions and you accurately report them to your claims administrator.

Examples of employment that’s generally allowed under regulations:

- Modified Duty: Your regular job, but adjusted to remove tasks you can’t safely perform (like lifting or standing long hours)

- Light-Duty Assignments: Temporary roles that are less physically or mentally demanding

- Alternative Work: A different position within the company that still meets your current medical limits

- Remote or Desk-Based Tasks: Office-based work or other sedentary roles

- Short-Term Transitional Programs: Limited assignments meant to gradually ease you back into the workplace

What matters most isn’t the industry or job position. It’s whether the tasks you’ll perform fit the restrictions and ensure they do not aggravate your existing injury.

How Medical Restrictions Determine Your Ability to Work?

Once you’re injured on the job, your medical status becomes a legal boundary on your earnings. More than just a recovery update, it’s the confirmation of your ability to work and earn. This process typically begins with your PTP’s evaluation of your current condition.

Role of Treating Physician in Certifying Work Capacity

Most work status decisions aren’t based on whether you feel better or not. They rely on a primary treating physician’s clinical assessment of exactly what tasks may put your recovery at risk.

Your PTP evaluates:

- Prior injury history that may affect healing or long-term limits

- Real-world testing of movement, stamina, or repetitive task tolerance

- Alignment with industrial job descriptions, not generic fitness levels

- Communication with claims administrators to clarify borderline cases

Physicians will then document their decisions in a way that can withstand review by insurance carriers, attorneys, and sometimes judges.

Impact of Temporary Disability Classifications (TTD, TPD)

Temporary disability classifications define your legal work status and directly impact how much payment you receive while recovering.

What actually triggers a classification:

- If your doctor determines you can’t safely perform any work at all, you’re classified as Temporary Totally Disabled (TTD).

- If you’re cleared to do some work under restrictions, you’re considered Temporary Partially Disabled (TPD).

This classification isn’t permanent. It can change week to week based on your progress or stay constant for months. And when it does change, your benefit payments adjust.

For example, if the doctor moves you from TTD to TPD mid-pay cycle, and you return to light duty, the claim may reduce or suspend your temporary disability benefits based on what you’re now earning.

Required Documentation in Medical Work Status Reports

Without a medical work status report, your employer can’t offer modified duties, and your claims administrator can’t process benefits correctly.

To be valid, a report must clearly include:

- The specific tasks you’re restricted from doing

- The duration those restrictions apply, whether temporary, ongoing, or reevaluation needed by a set date

- The medical justification for each restriction tied to diagnosis or objective findings

Your temporary disability classifications - The licensed physician’s credentials

Vague or missing details can delay benefits or cause disputes. A single incomplete report can hold up modified duty offers or force a return to TTD status.

Returning to Work With Modified or Alternative Duties

Medical clearance doesn’t automatically mean you’re returning to your old job. It simply means you’re able to work within certain limits. Here’s how the return-to-work process plays out under California law.

Modified Duty and Suitable Work Definitions

By workers’ comp law, modified duty refers to your usual job but adjusted to fit your physical or medical restrictions after a work injury. Suitable work is any position (temporary or permanent) that you can safely perform with those restrictions in place. Both must follow what’s written in your work status report, instead of just what seems manageable.

Employer's Obligation to Provide Modified Roles or Alternative Jobs

After medical clearance, your employer has a legal obligation to evaluate whether they can offer a job that fits. If they can, they have 60 days from the date of receiving the physician’s return-to-work report.

The job must:

- Last at least 12 months

- Be within a reasonable commuting distance

- Follow all listed medical restrictions

- Pay at least 85% of your pre-injury wages

If they can’t meet those standards, they’re not required to offer a position. But if they can and don’t, you may become eligible for additional benefits, like the Supplemental Job Displacement Benefit (SJDB).

Accepting or Rejecting Modified Job Offers

You have the legal right to either accept the modified job offer or turn it down. California workers’ comp law allows rejection only if there’s a valid reason not based on preference or discomfort.

Acceptable reasons to reject an offer include:

- The job exceeds your medical restrictions or involves duties your doctor hasn’t cleared you for

- It’s located too far from your home, based on commute standards

The offer is inadequate or unclear (not in writing)

Note that all rejections should be formally made in writing, with medical documentation attached.

Reporting Income While Receiving Workers’ Compensation

If you start working the modified or alternate job while on workers’ comp, you must report all earned income to your claims administrator, with no exceptions. California state law requires full transparency so benefits reflect actual wage loss, not inflated or duplicated earnings.

Acceptable reasons to reject an offer include:

- The job exceeds your medical restrictions or involves duties your doctor hasn’t cleared you for

- It’s located too far from your home, based on commute standards

The offer is inadequate or unclear (not in writing)

Note that all rejections should be formally made in writing, with medical documentation attached.

Working After Reaching Maximum Medical Improvement (MMI)

At some point in your recovery, your treating physician will decide you’re not getting significantly better, even with continued treatment. That’s called Maximum Medical Improvement, or MMI. It’s not the same as being fully healed. It means your condition has leveled out.

What MMI Means in Workers’ Compensation Claims?

In workers’ compensation claims, reaching MMI means that the temporary phase of your claim ends. Your doctor shifts focus from short-term restrictions to long-term limitations. At this stage, your legal and medical status changes, and so do your rights around work, wages, and benefits.

MMI triggers a Permanent and Stationary (P&S) report, which defines:

- End of temporary disability benefits

- Any future medical care needed

- Any lasting physical or mental restrictions

whether you’re cleared to return to work

Transition to permanent disability rating and benefits

Return-To-Work Options After MMI Status

Based on your MMI status, your return-to-work options fall into one of three categories:

- Full Duty: If your doctor clears you without restrictions, you can return to your regular job at your pre-injury capacity.

- Modified or Alternative Duty: If you’re given permanent restrictions, you may return to work only if your employer offers a role that matches those limits.

- No Job Offer: If no suitable work is available, you may be eligible for a Supplemental Job Displacement Benefit (SJDB) or proceed toward a permanent disability settlement.

Transition From Temporary to Permanent Disability Benefits

Once temporary disability ends after MMI, your benefits don’t stop. They just move into the permanent disability (PD) stage. Here’s how the transition usually occurs:

- Temporary benefits stop on the MMI date

- Either your doctor or a Qualified Medical Evaluator (QME) assigns a PD rating

- You receive PD payments, usually in small, scheduled installments

- You may begin settlement discussions, often involving both PD value and future care

Permanent disability benefits then compensate you for lasting physical or mental limitations that reduce your ability to earn a living.

Working Multiple Jobs or Starting a New Job While on Workers’ Comp

After medical clearance, working multiple jobs or starting a new one can shift how your benefits are calculated or continued. Whether you take on outside work, get laid off, or quit altogether, each situation triggers a different response under California workers’ compensation law.

Effect of Second Jobs on Workers’ Comp Benefits

Taking a second job while on workers’ comp can reduce your benefits or disqualify you altogether, depending on the work and your doctor’s restrictions. If the new job matches your medical limits and you report all earnings, you may still qualify for Temporary Partial Disability (TPD). But your benefits will be offset based on what you’re earning now.

If the job exceeds your restrictions or isn’t disclosed, your benefits can be suspended and flagged for review. Even cash gigs or short freelance projects count. What matters is compliance, not the job title.

Layoffs and Continued Workers’ Compensation Benefits

Layoffs do not end your workers’ compensation benefits, as long as you’re still within your medical restrictions and the injury remains work-related. If your employer can no longer accommodate your limitations, your disability benefits usually continue. California allows benefit recalculation based on updated income or no income (if you’re no longer working). Your medical treatment and legal rights stay active, but continued documentation from your treating physician is key to keeping benefits flowing.

Quitting Your Job and Permanent Disability Rights

Quitting your job doesn’t cancel your right to permanent disability benefits, but it can affect how your case is valued or negotiated. If you voluntarily leave your position after reaching MMI, your employer may argue that modified work was available. That could reduce your leverage in settlement talks or limit your access to certain return-to-work benefits. However, your right to receive PD payments remains.

Legal Consequences of Violating Work Restrictions

Workers’ comp laws treat medical restrictions as enforceable, not optional. If you knowingly work beyond what your doctor has approved or hide income while collecting benefits, you could be in violation. These breach cases go beyond the claim adjuster’s control and can be referred to the state’s insurance fraud division.

Examples of Work Activities That Breach Medical Limitations

Performing any activity your doctor has explicitly ruled out means breaching medical limitations. For example:

- Lifting heavy objects when restricted to light-duty only

- Driving for rideshare work while under restrictions for mobility or medication

- Doing construction, landscaping, or warehouse tasks when cleared for desk duty only

- Working long hours or double shifts when limited to part-time

- Performing physical tasks “off the clock” that mirror restricted job functions

Even helping a friend move or doing unpaid family business work can trigger violations and penalties if it crosses your documented limits.

Consequences of Misrepresenting Work Status or Earnings

Working outside your approved limits or misreporting/underreporting earned income can lead to serious consequences, ranging from paused benefits to criminal charges.

Possible consequences:

- Benefit suspension or repayment

- Claim denial or closure

- Civil fines or monetary penalties

In more serious cases, you can get a criminal prosecution for workers’ compensation fraud.

Fraud Investigation Process in Workers’ Comp Claims

When claim administrators suspect fraud, they refer your case to the state’s Department of Insurance Fraud Division for investigation.

That process typically involves:

- Surveillance: Monitoring your physical activity and comparing it to your restrictions

- Medical Record Review: Reviewing your medical records to verify actions that violate reported limitations

Income - Verification: Examining tax returns, bank records, and pay stubs

- Interviews: Questioning you, your employer, or witnesses about your work duties

- Formal Fraud Report: Filing a formal report if the evidence shows a clear violation

An investigation doesn’t automatically mean you committed fraud, but ignoring requests or submitting inconsistent documentation can quickly escalate the case.

What to Do If Your Workers’ Comp Benefits Stop After You Return to Work?

Benefits can stop without warning, even if you’re still following your medical restrictions. Sometimes it’s just a paperwork error. More often, the insurer confirms that the justification for paying benefits no longer exists.

Common Reasons for Denial of Benefits

Your benefits don’t end without a trigger. Here are the most common reasons insurance companies provide:

- Your doctor reports you’re medically capable for full duty

- Your employer claims they offered suitable work you didn’t accept

- You miss a medical appointment or delay paperwork

- You begin earning income and fail to report it

- The claims administrator disputes your disability status

You reach MMI, and your temporary benefits expire

If your benefits stopped for valid reasons, no further disability payments are due. However, if your benefits stop incorrectly, you must take immediate steps to challenge it.

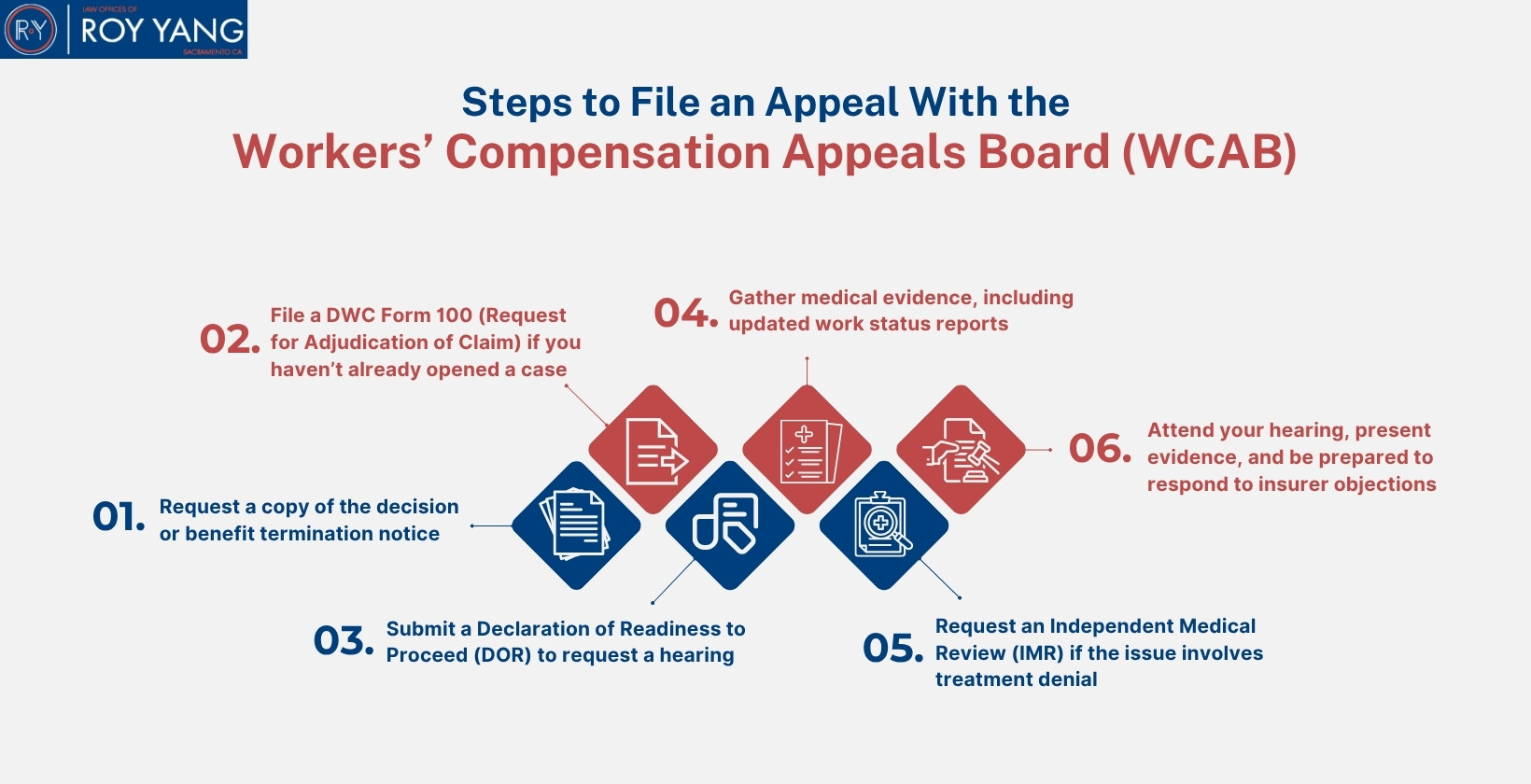

Steps to File an Appeal With the Workers’ Compensation Appeals Board (WCAB)

Upon suspension or termination of your benefits, you may appeal the decision by filing a case before the Workers’ Compensation Appeals Board (WCAB).

The step-by-step workers’ compensation appeal process:

Step 1: Request a copy of the decision or benefit termination notice

Step 2: File a DWC Form 100 (Request for Adjudication of Claim) if you haven’t already opened a case

Step 3: Submit a Declaration of Readiness to Proceed (DOR) to request a hearing

Step 4: Gather medical evidence, including updated work status reports

Step 5: Request an Independent Medical Review (IMR) if the issue involves treatment denial

Step 6: Attend your hearing, present evidence, and be prepared to respond to insurer objections

Don’t delay because the appeal deadlines are strict. Most work comp appeals require formal filing within 20 days of receiving the decision notice.

Rights and Responsibilities When Returning to Work After a Job Injury

Returning to work doesn’t end your claim. It triggers a new set of legal rights and compliance duties for you and your employer. If you’re back on the job after a work injury, you’re still protected under state comp law, but now you must also follow ongoing reporting and medical requirements.

Here’s what both employee and employer are expected to do.

Employee Rights Under California Workers’ Compensation Law

You have legal protections when you return to work with a comp claim still open. Your rights include:

- Protection against retaliation

- Right to reasonable accommodation

- Access to continued medical care

- Right to refuse unsafe work that exceeds your medical limitations

- Right to dispute any return-to-work offer that doesn’t meet your restrictions

If your employer violates any of these rights, you can file a claim with the WCAB or contact the state’s Labor Commissioner.

Responsibilities for Staying Compliant With Benefit Rules

Once you’re back at work, you must follow strict reporting and compliance guidelines to keep your claim in good standing.

Your responsibilities include:

- Attending all scheduled medical appointments

- Following all restrictions listed in your most recent work status report

- Reporting any changes in your work duties or physical condition to your doctor

- Disclosing all income earned while your claim remains open

Failing to follow these steps could result in benefit delays or denials, even if you’re still injured.

Employer Duties During Reintegration to the Workplace

Your employer must follow the law when bringing you back to work after an injury. Under Labor Code §4658(d), the employer must:

- Respect your medical restrictions in any modified or alternative work

- Avoid assignments that could aggravate your injury or delay recovery

- Offer suitable work, if available

Maintain a safe working environment for all returning employees

While your employer isn’t obligated to accommodate your restrictions, they also can’t force you to do work that goes against those restrictions.

Frequently Asked Questions About Working While on Workers’ Compensation

Can my employer fire me while I’m on workers’ comp?

Yes, your employer can terminate you while you’re on workers’ comp, but not because you filed a claim. If the termination is unrelated to your injury (such as layoffs or misconduct), it may still be legal.

Can I adjust my work schedule during recovery on workers’ comp?

Yes, you can adjust your work schedule if your doctor approves modified hours or tasks. Any changes must match your medical restrictions and be coordinated with your employer and claims administrator.

Can I earn side income from a hobby while on workers' comp?

Yes, but you must report it. Even hobby-related earnings can affect your benefits if they involve activity beyond your restrictions.

Can I sue my employer if wrongly denied workers’ compensation?

Yes. You can sue your employer if you were wrongly denied workers’ comp and meet the legal definition of an employee under California law.

What if I start feeling better before my doctor clears me for work?

You still must wait for medical clearance before returning to work. Feeling better doesn’t override your doctor’s legal authority. Working without approval can put your benefits at risk.

What’s the maximum benefit duration for temporary disability in CA?

You can receive temporary disability benefits for up to 104 weeks within a 5-year period from your injury date.

What happens if I delay reporting income while on workers' comp?

Delaying income reporting can result in overpayment, reduced benefits, or a fraud investigation. You must disclose all earnings while receiving benefits, even if the income seems minor or part-time.

Can I switch doctors if I disagree with my work restrictions?

Yes, you can request a new doctor within your employer’s Medical Provider Network (MPN). If you’re outside the MPN or there’s a dispute, you can request a panel Qualified Medical Evaluator (QME).

Can my work hours be limited by my medical restrictions?

Yes, your doctor can limit your work hours based on your condition. Reduced schedules must appear in your written work status report to carry legal weight.

Key Takeaways on Working While Receiving California Workers’ Compensation

Let’s bring it all together: working while on workers’ comp isn’t off-limits, but it comes with strict conditions. Remember these factors that work together to protect your rights to work, define your legal duties, and help you enjoy benefits.

Doctor’s approval > Medical restrictions > A suitable work offer >Proper income reporting

If your benefits suddenly stop or you’re unsure whether your current job offer is legal, speaking with a workers’ compensation attorney can help clarify your rights and next steps.

Have questions about your rights while on workers’ comp? Contact us now for expert advice or call (888)-533-8703 today to ensure you’re staying compliant!